Not all GenAI use cases are valuable yet, Google's moat and Mexican regulators against bundling

19 February 2024 | Issue #18 - Mentions $MSFT, $GOOG, OpenAI, $META, $NFLX, $AMZN, $MELI

Welcome to the eighteenth edition of Tech takes from the cheap seats. This will be my public journal, where I aim to write weekly on tech and consumer news and trends that I thought were interesting.

Quick personal note: I’m back to writing after a short hiatus. For those of you that missed my tweet in December, I’ve left the fund I was working at in Australia to move to New York City. If you’re ever in town I’m always keen to chat stocks/tech!

I’m also actively looking for a seat, so any leads would also be greatly appreciated. My writing pattern will be sporadic going forward but hoping to get something out when I have interesting things to say. Thanks for all your support! Without further ado…

Let’s dig in.

Is AI worth the price?

If you’ve been following along this newsletter for a while you’d know a common theme I’ve been writing about has been the capital investments into AI infrastructure and the ROI that will be needed to be generated from it. We live in a capitalist society after all. Money spent on investments should generate economic profits (unless you’re the government).

AI has generated over a $trillion in market value for Microsoft since the launch of ChatGPT in November 2022 (this is crude, I know). Other key timestamps were in March 2023 when the company announced Office 365 co-pilot and July 2023 when they announced the price.

Source: Koyfin

What I find really interesting is that Sales and EPS estimates for FY1 and FY2 are lower than what they were late November. So even though AI has added to the company’s market cap over this time, it isn’t expected to hit the company’s financials in the medium term. This week’s article from the WSJ notes some speed bumps into the path to value creation for AI.

Source: Koyfin

Microsoft’s new artificial-intelligence assistant for its bestselling software has been in the hands of testers for more than six months and their reviews are in: useful, but often doesn’t live up to its price.

The company is hoping for one of its biggest hits in decades with Copilot for Microsoft 365, an AI upgrade that plugs into Word, Outlook and Teams. It uses the same technology as OpenAI’s ChatGPT and can summarize emails, generate text and create documents based on natural language prompts.

Companies involved in testing say their employees have been clamoring to test the tool—at least initially. So far, the shortcomings with software including Excel and PowerPoint and its tendency to make mistakes have given some testers pause about whether, at $30 a head per month, it is worth the price.

The company has seen some good success with GitHub Copilot, but other areas of the business have been more lukewarm.

Microsoft’s earlier AI upgrades have had mixed results. In 2022, the company released GitHub Copilot, which helps programmers write code faster using AI. The feature, which starts at $10 a month, has 1.3 million subscribers—up 30% from the previous quarter, Microsoft executives said.

The AI-powered chatbot added to Bing search has struggled to make waves. Despite a flashy rollout from Microsoft, it didn’t make much of a dent in Google’s search market share. Executives had expected potentially billions in new revenue if Bing gained on Google, and nearly a year later, Bing has gained less than 1 percentage point of market share.

Some companies are hesitant to dive into adopting AI technology. A survey from Boston Consulting Group showed that while nearly 90% of business executives said generative AI was a top priority for their companies this year, nearly two-thirds said it would take at least two years for the technology to move beyond hype. About 70% of them were focused only on small-scale and limited tests.

Microsoft had been betting that the desire to use the AI would persuade companies to sign up for massive contracts. When it made the assistant widely available in November, companies had to sign up for at least 300 subscriptions. Many were resistant to that size of commitment for unproven software, said a Microsoft software reseller.

Last month, Microsoft eased its minimum requirement, allowing businesses to pilot the software with much smaller groups.

Some workers are finding value out of it though, noting efficiency gains from summaries on Teams or writing first drafts on Word. However, similarly to ChatGPT, Copilot also has problems with hallucinations.

In other areas, testers say the tech has fallen short: Copilot for Microsoft 365, including other generative AI tools, sometimes hallucinated, meaning it fabricated responses. Users said Copilot, at times, would make mistakes on meeting summaries.

At one ad agency, a Copilot-generated summary of a meeting once said that “Bob” spoke about “product strategy.”

The problem was that no one named Bob was on the call and no one spoke about product strategy, an executive at the company said.

In other programs—particularly the ones that handle numbers—hallucinations ****are more problematic. Testers said Excel was one of the programs on which they were less likely to use the AI assistant because asking it to crunch numbers sometimes generated mistakes.

These challenges are expected to gradually resolve themselves as the system becomes more sophisticated. However, this may delay the widespread adoption of the technology. A silver lining for Microsoft, though, is that Copilot appears to excel in applications that demand smaller models and less computational power. This bodes well for profit margins (I wrote about this here).

Related: AI Pricing vs. Efficiency Gains, Air Canada has to Honor a Refund Policy Its Chatbot Made Up

…maybe for some companies?

While the revenue opportunity from AI is encountering speed bumps for (some of) big Tech, the cost opportunity continues to shine through.

Google has introduced a coding assistant ‘Goose’ for internal use.

This tool, leveraging Google’s cutting-edge artificial intelligence model Gemini, represents a significant stride in automating and streamlining coding processes within the company. According to internal documentation, Goose is developed on a foundation of Google’s extensive 25-year history of engineering knowledge, showcasing the tech giant’s commitment to harnessing its AI investments not only for market-facing innovations but also for internal efficiency gains.

Previously, Google engineers had access to an internal code generation tool, akin to GitHub Copilot, which has been available since late 2022. The introduction of Goose, however, marks a notable advancement in the sophistication and potential utility of AI-assisted coding at Google.

Amid promises to investors to pare down expenses, Google’s deployment of Goose aligns with its broader strategy of automating various company functions, including advertising sales. Such automation efforts involve the use of AI to craft advertising campaigns autonomously, reflecting a shift towards reducing operational costs and potentially diminishing the need for certain engineering roles.

By integrating Gemini’s AI capabilities into the development of Goose, Google aims to accelerate product development timelines and foster a more efficient engineering environment. This initiative underscores Google’s dedication to leading in AI technology application, both externally in its product offerings and internally within its operational methodologies.

On a somewhat related note, this week OpenAI announced it’s own text-to-video generation tool, Sora.

OpenAI is launching a new video-generation model, and it’s called Sora. The AI company says Sora “can create realistic and imaginative scenes from text instructions.” The text-to-video model allows users to create photorealistic videos up to a minute long — all based on prompts they’ve written.

Sora is capable of creating “complex scenes with multiple characters, specific types of motion, and accurate details of the subject and background,” according to OpenAI’s introductory blog post. The company also notes that the model can understand how objects “exist in the physical world,” as well as “accurately interpret props and generate compelling characters that express vibrant emotions.”

…

A couple of years ago, it was text-to-image generators like Midjourney that were at the forefront of models’ ability to turn words into images. But recently, video has begun to improve at a remarkable pace: companies like Runway and Pika have shown impressive text-to-video models of their own, and Google’s Lumiere figures to be one of OpenAI’s primary competitors in this space, too. Similar to Sora, Lumiere gives users text-to-video tools and also lets them create videos from a still image.

The quality of output from these generators is improving rapidly. Meta introduced Make-A-Video in September 2022, and the difference between that and Sora is substantial. Even Google's Lumiere, introduced just a few weeks ago, offers five-second clips compared to Sora's sixty-second ones. According to the technical report, Sora's video quality improves as more training compute is used.

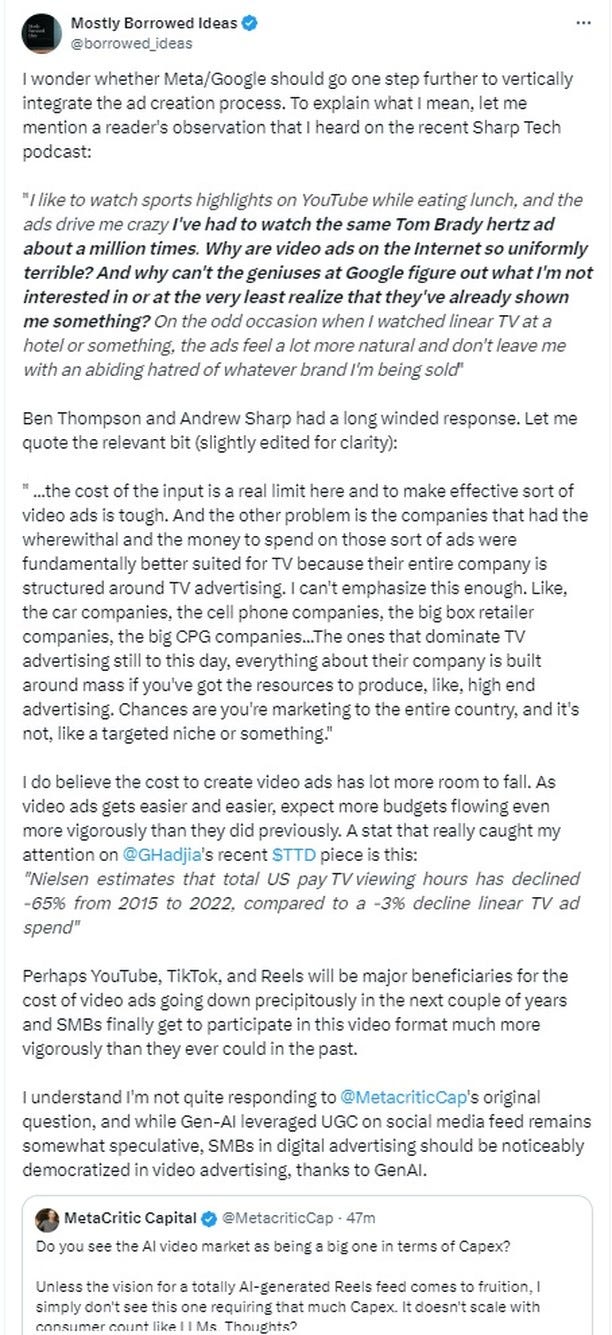

Visualizing the extent to which AI can enhance efficiency for certain companies is becoming easier. MBI posted a thoughtful tweet that considered this in relation to Google and Meta.

I always anticipated that GenAI could become powerful enough to assist in the ad creation process, but I didn't expect it to be able to happen this quickly. Meta and Google already utilize AI-based tools, Advantage+ and Performance Max, which automatically streamline the bidding process across their channels. Inclusion of the ad creation process, combined with conversion data, will make it challenging for advertisers to consider alternative platforms. The AI/ML algorithm can learn from conversion data to determine which parts of the ad are effective for different audiences. Netflix already employs a similar strategy with its thumbnails.

Sora is not limited to creating videos from text. It also allows for editing inputted videos using descriptions.

From the technical report:

This opens up many possibilities, including the intriguing prospect of creating sequels to TV shows or movies using past productions as inputs. It appears that Netflix is exploring some of the potential uses of GenAI for content. Following this development promises to be quite exciting.

Google’s moat being questioned episode 4

Another big piece of news this week was OpenAI’s foray into search

OpenAI has been developing a web search product that would bring the Microsoft-backed startup into more direct competition with Google, according to someone with knowledge of OpenAI’s plans.

The search service would be partly powered by Bing, this person said.

The move to launch a search app comes a year after Microsoft CEO Satya Nadella said his company would “make Google dance” by incorporating artificial intelligence from OpenAI into Microsoft’s Bing search engine. That partnership has failed to dent Google’s search dominance.

It isn’t clear whether the search product would be separate from ChatGPT, the chatbot OpenAI runs and which also uses Bing’s index of the web to retrieve information to answer some questions. But ChatGPT, which runs in Microsoft’s data centers, isn’t as fast as Google in answering questions. OpenAI could be looking to speed up the service, which can be slow because it also does tasks like proofreading email drafts, generating poetry or computer code.

The success of OpenAI in search largely depends on distribution. This is evident from the DoJ’s antitrust case against Google, which shows the importance of default settings and the difficulty in overcoming inertia. Despite these challenges, ChatGPT has successfully garnered 100 million weekly active users through word-of-mouth. This is noteworthy, given that even Microsoft has faced difficulties penetrating the search engine market, despite owning the Windows operating system and Office suite.

As this tweet from Compound highlights, unless ChatGPT becomes the default search on devices like iPhones and Androids, it may struggle to seize a significant share from Google.

Business model considerations, such as traffic monetization, are also crucial, but perhaps that's a discussion for another day.

Mexico’s regulator says no to providing customer value

This piece of news seemed to have slipped under the radar

From The Information

Mexico’s antitrust regulator said Tuesday that several of Amazon’s business practices stifle competition, including bundling its streaming service as part of its Prime subscription and incentivizing merchants who sell on Amazon’s e-commerce site to use its fulfillment services. The critiques echo similar criticisms from antitrust authorities in the U.S. and European Union.

In a preliminary order, Mexico’s Federal Commission on Economic Competition also targeted Mercado Libre, a $87 billion e-commerce firm focused on Latin America that offers its own Prime-like subscription service that includes free shipping and access to Disney streaming services. The two companies’ tactics have created “an absence of real competitive conditions in the online retail market” that has allowed them to control 85% of Mexican online sales, the regulator said. The regulator said that Amazon and Mercado Libre can offer streaming services independently, but should not offer them as part of subscription packages related to their e-commerce marketplaces.

The regulator also targeted several other practices. Amazon and Mercado Libre should not give merchants who use the companies’ own fulfillment services an advantage in search results, the regulator said. In addition, the regulator said Amazon should give merchants more information about how it determines what items are featured in the “Buy Box”— the section of a product page that features prominent “Buy Now” and “Add to Cart” buttons. The regulator recommended the Mexican government require the two companies to implement “corrective measures” to address its concerns within six months.

I found this article by the Harvard Business Review helpful in understanding the FTC's complaint against Amazon. The complaint from the Mexican regulator appears to be narrower but includes Mercado Libre. The regulator suggests that Amazon and Mercado Libre could offer their streaming services separately, rather than as a bundle. However, the authors of the HBR article doubt the effectiveness of this approach.

We tend to be skeptical of heavy-handed structural remedies, such as breaking up Amazon’s product brands, fulfillment services, and marketplace into separate business entities. This is a very blunt instrument: While it may preclude some of the potentially harmful behaviors mentioned above, it would also deprive both consumers and third-party sellers of significant benefits such as scale and scope economies and one-stop shop convenience.

Behavioral remedies are more reasonable: Any conduct proven to be illegal should be banned. If, for example, the FTC proves that Amazon’s enforcement of price parity is illegal, the FTC would be justified in preventing this practice and in determining monetary damages that reflect consumer harm. The same goes for self-preferencing.

I am not well-versed in Mexican law, so we'll need to keep an eye on developments over the next six months. I don't see any harm to consumers from the bundling of services, given the added value they provide. However, there could be a protectionist aspect at play here.

That’s all for this week. If you’ve made it this far, thanks for reading. If you’ve enjoyed this newsletter, consider subscribing or sharing with a friend

I welcome any thoughts or feedback, feel free to shoot me an email at portseacapital@gmail.com. None of this is investment advice, do your own due diligence.

Tickers: MSFT 0.00%↑ , GOOG 0.00%↑ , META 0.00%↑ , NFLX 0.00%↑ , AMZN 0.00%↑ , MELI 0.00%↑