Threads is dead, long live threads

Welcome to issue #1 of Tech takes from the cheap seats. This will be my public journal, where I aim to write weekly on tech and consumer news/trends that I thought were interesting.

16th July 2023 - Mentions META 0.00%↑, NOW 0.00%↑, RBLX 0.00%↑, MSFT 0.00%↑, ATVI 0.00%↑, DPZ 0.00%↑, GRAB 0.00%↑, SE 0.00%↑

Hello! Thanks for being an early adopter of Tech takes.

Get ready for a curated newsletter featuring intriguing highlights from the week's news and trends. Through an investing lens, I break down and analyze these topics, providing valuable insights in a concise format.

Let’s dig in.

The beauty about writing on highlights for the week - and not daily - is that it allows me to soak in and reflect on the topics before sharing them publicly. With trends changing at lightning speed in today's internet-driven world, the shelf-life of knowledge and written content can quickly become outdated.

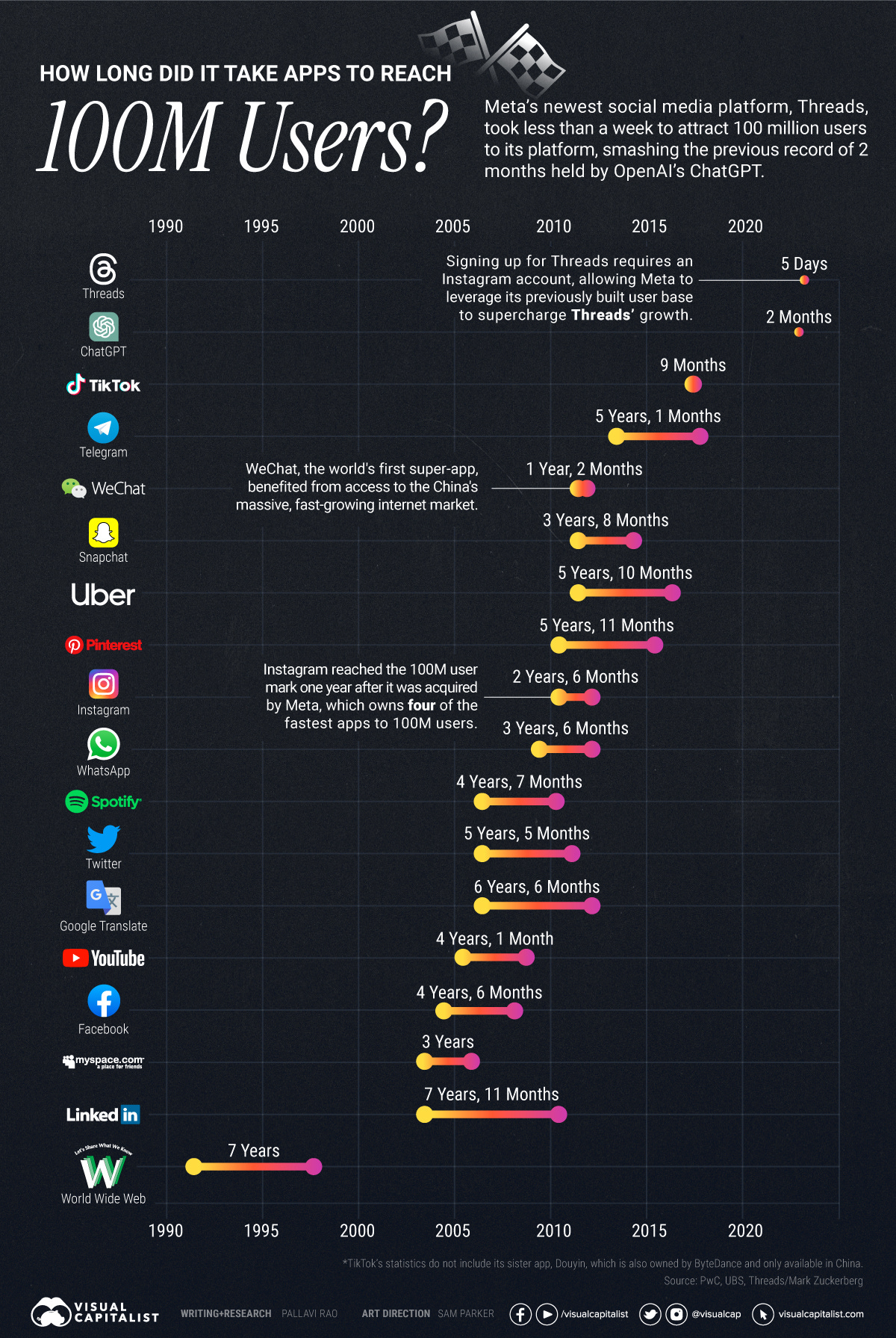

Take for instance the news that Meta Platforms (FKA Facebook) owned-app Threads reached 100 million users (in five days!) at the beginning of this week. A super impressive feat considering it was done with a team of just three product managers, three designers and “50ish” engineers who created and launched it within five months! For context, the next quickest app to gain 100 million users was ChatGPT at 2 months. It’s not completely comparable though, since Threads was able to leverage Instagram’s 2.35+ billion users to easily create an account by importing existing data. Still, this doesn’t guarantee its success. Meta has had a long history of cloning competitor’s apps. This isn’t even the first time they’ve launched an app called Threads. Version 1.0 was a direct messaging app that was meant to be for close friends on Instagram to communicate with both pictures and words, similar to something like Snapchat. It ended up being deprecated because people just didn’t find incremental use for it on-top of IG DMs. These failures show that even with a large distribution network, scaling apps to critical mass is really hard (Threads v1.0 had just over 200,000 users before it shut down.)

So why is Threads dead? Three days after it reached 100 million users, app tracking firms SensorTower and SimilarWeb reported a significant pullback in user engagement since Threads’ launch.

“On Tuesday and Wednesday, the platform’s number of daily active users were down about 20% from Saturday, and the time spent per user was down 50%, from 20 minutes to 10 minutes”.

This, and data from Google Trends showing a decline in interest in Threads vs Twitter since July 6 has led to calls of the death of Threads.

I think we need to put things into perspective. Andrew Chen from a16z wrote an excellent article on the base rate of retention for new apps.

Based on Quettra’s data, we can see that the average app loses 77% of its DAUs within the first 3 days after the install. Within 30 days, it’s lost 90% of DAUs. Within 90 days, it’s over 95%

For the top 10 Apps, Day 3 retention is around 75%. Threads' Day 5/6 retention is an implied 80%. This puts it in the top decile of apps in terms of retention after launch - an incredible feat considering its scale. And as Andrew helpfully mentions, when these DAUs are being “lost” it doesn’t mean that users are suddenly going completely inactive - they might just be using the app once per week, or a few times a month. For context, the DAU/MAU ratio for all 'Family apps’ (Facebook, Instagram, Messenger and Whatsapp) was 79% in Q1’23 while it was 68% for Facebook.

I’d bet if you were to poll the population before its launch on how many users would sign up for Threads within a week, very few would’ve picked over 100 million. It’s arguably been launched as a beta product with very limited features compared to the competition (Twitter) but the team are backed by a social media gorilla with $billions in resources and a deep bench of engineering talent. Calling the app dead after 10 days and 100+ million in downloads seems a little pre-mature. I wouldn’t count them out just yet.

Related: Threads to Add $8 Billion to Meta Annual Revenue by 2025, Analyst Says

Billy Mac continues to execute

The new Magic Quadrant for Application Performance Monitoring and Observability was released this week. Gartner’s MQ is one of the software industry’s leading reports on assessing product capabilities and competitive positioning. It’s also a great marketing tool - when Gartner makes you a leader in the MQ, Value added resellers become very eager to sell your product.

There was nothing too surprising. Dynatrace, Datadog and New Relic remained the top three vendors in the space (although Datadog seems to have dropped off a bit). What I found interesting was that ServiceNow, traditionally known for being the leader in the IT Service Management and Operations space, has popped up for the first time on the APM MQ (and as a Visionary to boot). Pretty impressive as its Cloud Observability product was created recently as a result of the acquisitions of Lightstep (in 2021) and Era Software (in 2022). It is early days, but it seems the ServiceNow platform is continuing to resonate with other departments and spreading from its humble helpdesk beginnings.

Of course, I’m reminded of this excellent quote from Larry Ellison in his bio Softwar.

“Most analysts try to foretell the future by understanding and explaining the recent past. If you have a bad quarter, if your sales are going down, they will attribute part of that sales decline to product problems that are creating competitive pressures. If you suddenly have a good quarter, better than the competition, they explain that it’s because your product is getting better. It’s as simple as that - they just look at the numbers. So the best way to improve the perception of the E-Business Suite is to sell more of it. Then the analysts will say, ‘Good job, Oracle, it’s a great product you got there.’”

It may just be that the consultants are seeing lots of demand for ServiceNow’s Observability Cloud and so they think it must be a pretty great product. Either way, it’s a positive development for the company.

Roblox is coming to (another?) metaverse

I say another because people already perceive the game as the world’s biggest metaverse. It is currently played by more than 66 million people in a continuous virtual playground of evolving experiences with a vast marketplace. This week, the company announced that it will soon be available on Meta Quest, the leading VR headset. With all the news surrounding Threads lately it’s easy to forget about Meta’s other ambitions of owning the metaverse. I thought this was a huge development considering Roblox has an ecosystem of 9.5m developers on the platform. This will accelerate game development and adoption of the Quest headset and considering that >50% of the 66m Roblox users are under 13, means this demographic is getting introduced to VR devices at an early stage of their lives. I won’t talk to whether I think that’s right or wrong but it does create an interesting opportunity for Meta.

The FTC cops another L

The $75bn Microsoft-Activision deal has been one of the biggest in the last few years. I won’t add anything further to the discussion given that there are people way smarter than me breaking this down. All I’ll say is I’m glad common sense prevailed in this instance (Xbox is nowhere near a monopoly in gaming/consoles) and Lina Khan’s crusade against big tech acquisitions is falling apart.

Domino’s finally throws in the towel

Domino’s Pizza, one of the last fast-food chains holding out on being on third-party delivery platforms, signed a deal with Uber to list its menus on the ride-share company’s Eats and Postmates delivery apps across 28 of the pizza' chain’s markets. Its driver delivery network was considered a key competitive advantage. Domino’s had been delivery pizza for over 60 years and feeding a family with a cheap meal in less than 30 minutes was an attractive proposition. 3P delivery platforms coming to the market over the years has caused headwinds for pizza shops as its once-exclusive service became commoditized. The COVID-19 pandemic propelled the demand for food delivery to new heights, while simultaneously creating challenges in the supply of delivery drivers. This surge in demand can be attributed not only to labor shortages caused by stimulus checks but also to the allure of working for (3P) delivery platforms, which offered enhanced earning potential and flexibility for drivers.

Domino’s (while led by previous CEO Ritch Allison) has been vocal in the past about not using 3P delivery so it’s interesting to see the company change strategic direction under its new CEO Russell Weiner. Delivery platforms have become dominant aggregators of demand and supply, reaching a scale where businesses find it almost unavoidable to pay their 15-30% take.

Fintech deposit limits in Singapore

Bloomberg reported that Singapore’s new digital banks backed by Grab and Sea are pushing the country’s central bank to lift a cap on deposits that they see as hamstringing their growth. Both banks are approaching the S$50m (US$37.6m) limit and have been lobbying the Monetary Authority of Singapore to review its stance.

The article goes on to say that rival digibank Trust Bank, backed by Standard Chartered doesn’t face the same restriction and accumulated more than S$1bn nine months after its launch. Grab’s digital bank neared the regulatory cap “within months” of launching its savings account, and the waitlist to open such an account “continues to grow organically every day.”

For context, Sea’s fintech segment had US$2bn in total loans receivable as of 1Q’23. A cap of S$50m doesn’t seem like very much at all and punitive for new entrants. I’m not close to financial regulation in Singapore but a lift in the cap would be a positive development fintech businesses in the form of cheaper access to capital.

That’s all for this week. If you’ve made it this far, thanks for reading. If you’ve enjoyed this newsletter, consider subscribing or sharing with a friend

I welcome any thoughts or feedback, feel free to shoot me an email at portseacapital@gmail.com. None of this is investment advice, do your own due diligence.