What's really happening in software, ad saturation, and TikTok pulling back

2 June 2024 | Issue #23 - Mentions $CRM, $MSFT, $MDB, $VEEV, $PYPL, $AMZN, $GOOG, TikTok

Welcome to the twenty-third edition of Tech takes from the cheap seats. This will be my public journal, where I aim to write weekly on tech and consumer news and trends that I thought were interesting.

Let’s dig in.

What’s really happening in enterprise Software?

This week was a bloodbath for software stocks, triggered by another off-calendar (April-end) reporting enterprise SaaS company, Salesforce, guiding for weaker than expected revenue and bookings growth due to greater deal scrutiny.

From the WSJ

Turns out, a more profitable Salesforce CRM 7.54% isn’t that exciting when growth is grinding to a halt. Especially when investors have a culprit like artificial intelligence to blame.

The cloud software company isn’t yet in no-growth territory. But its fiscal first quarter results and forecast late Wednesday put it a bit closer. Revenue for the quarter ending in April rose by a record-low 10.7% year over year to $9.1 billion, and the company projected just 7% growth for the current period. Both were below Wall Street’s forecasts.

More important, billings—a measure of business transacted during the quarter—increased an anemic 3% year over year, another record low and well under the 9% growth analysts had expected.

And Salesforce’s current remaining performance obligation, which measures contracted revenue not yet recognized, rose 9.5% year over year—the first time that metric has fallen short of double-digit growth.

Salesforce also delivered adjusted operating margins above 32% for the first time ever. But two decades of treating strong growth as its North Star means a more robust bottom line can’t fully offset top-line weakness. Tyler Radke of Citigroup called the results “very disappointing” in a note to clients. Salesforce shares sank nearly 20% Thursday—the stock’s worst single-day decline in nearly 20 years, according to FactSet.

What happened? During the company’s earnings call Wednesday—between 35 utterances of the word “incredible” by Chief Executive Marc Benioff—other Salesforce executives described an environment in which major deals are taking longer to close, if they close at all.

“We saw compression on many deals that we ultimately ended up getting done,” said President Brian Millham, “but they got smaller when we ultimately closed them.”

Smaller deals aren’t great news for a software company now generating nearly $36 billion in annual revenue. Especially when much-larger Microsoft MSFT 0.11% is now expanding its business at a faster rate, thanks in part to burgeoning demand for its generative artificial-intelligence services.

But Salesforce isn’t alone. The current earnings season has largely been a rough one for cloud software providers. Workday WDAY 1.93%increase; green up pointing triangle saw its shares sink more than 15% last week following its report for the April quarter, which included disappointing billings growth and a trim to its full-year projection for subscription revenue. That was the worst single-day selloff for the stock in more than eight years.

Workday cited “increased deal scrutiny,” with CEO Carl Eschenbach adding that customers were committing to “lower head-count levels” on deal renewals. Cloud deals are typically based on the number of employees—or seats—that will have access to the software.

Also last week, Snowflake SNOW -3.38% saw its stock fall 5% following its own report, which included a sharp cut to its operating margin projection for the year because of its AI investments. That was after its stock had already shed nearly 18% this year.

Stocks of Adobe ADBE -0.25%, ServiceNow NOW 2.12% and Atlassian TEAM -2.20% also fell after reporting results for the March quarter. Of the 10 largest cloud software providers by annual revenue, eight have seen their stocks sell off by an average of 9% the day after their latest results, according to FactSet data.

It likely is no coincidence that the tighter deal environment comes as more companies are pouring investment dollars into generative AI. That is a point that cloud software executives are all hesitant to address, given that they are also building their own AI services with haste.

But some on Wall Street are starting to make the connection. In a note to clients Thursday, Brian Schwartz of Oppenheimer said that “the slowdown in enterprise software spending likely reflects AI crowding out investments and slower hiring.”

I had called out this possibility a month ago after seeing some March-end software companies report downgrades to their year end guidance.

But of course the magnitude of these price moves (the software index, IGV was down almost 10% in a week!) had some people on fintwit calling for the death of software due to AI. All because of a couple percentage point downgrades in revenue/bookings…!

So what’s really happening in software? Is it macro? Was Q4 only strong due to a budget flush (where companies try to spend whatever’s left of their budget so they don’t lose it)? Is AI crowding out other spend? Or do companies no longer need to buy software because they’re making it themselves with AI? I’m going to have a go at answering some of this, but first let me provide some context using Salesforce.

Shares started to de-rate from their late 2021 highs as the interest rate environment was set to tighten and companies were getting cautious with their expenses. The macro environment was getting worse for software spending. Salesforce started to call this out at their Q2 2023 (off-calendar reporting means that Salesforce FY23 = FY22) earnings in August 2022.

“Now for those of you who have been on these calls with us, we've all been through a number of these economic cycles. And we've especially seen that over our last 23 years. And once like this come around, we see customers becoming more measured in the way they buy. Sales cycles can get stretched. Deals are inspected by higher levels of management, and all of this, we began to start to see in July. Nearly everyone I've talked to is taking a more measured approach to their business. We expect these trends to continue in the near term, and we reflected this in our guidance. Given the significant impact of foreign exchange and buyers being more measured, we're revising our fiscal '23 revenue guidance to $30.9 billion to $31 billion or about 17% growth year-over-year or 20% in constant currency. At the same time, we're maintaining our fiscal year '23 operating margin guide of 20.4%, an expansion of 170 basis points year-over-year. This is further evidence that we remain deeply committed to consistent, disciplined margin, cash flow and revenue growth as part of our long-term plan to drive both top and bottom line performance.” - Marc Benioff

At their Q3 results on November 30 2022, the environment got worse.

“Before moving to our guidance, I'd like to comment on the current economic environment. You recall that last quarter, we noted measured customer buying behavior really beginning in July. This led to elongated sales cycles, additional deal approval layers and deal compression, particularly in enterprise. As Q3 progressed, we saw an even more challenging buying environment, driving intense customer scrutiny on every investment dollar to ensure the highest return possible. During Q3, this behavior was most pronounced in our U.S. and major European markets, while Japan remained more resilient. From an industry perspective, the most impacted were retail, consumer goods and communications and media, while the more resilient were travel and hospitality, manufacturing, automotive and energy. And from a product perspective, we continue to see customer spending pressure in commerce and marketing.” - Marc Benioff

Something else happened on this day though. It was the day of the release of ChatGPT. But we’ll come back to this.

Q4 results on March 1st 2023 still saw a measured buying environment, however the market had started to re-rate the shares on optimism from AI. Salesforce started to showcase on its call what AI could do for its customers.

“Before moving to our guidance, I want to briefly discuss the current macro environment. In Q4, we continued to see the measured environment we've called out over the past 2 quarters. This resulted again in elongated sales cycles, additional deal approval layers and deal compression. Our guidance assumes these trends persist with no material improvement or deterioration.”

“On revenue, we are expecting $34.5 billion to $34.7 billion, representing over 10% growth year-over-year and the same in constant currency.” - Amy Weaver

“This is only the beginning of what's possible. As we build more native automation, intelligence and real-time integration deeper into our Data Cloud and apps, and we're rebalancing our resources to be Data Cloud-first inside our company. And next week, at our TrailheadDX conference in San Francisco on March 7 and 8, you'll see how we're bringing even more innovation through our platform with our new EinsteinGPT technology, the world's first generative AI for CRM, a tremendous complement to our Data Cloud and core Einstein AI platform. EinsteinGPT will be integrated into all of our clouds as well as Tableau, MuleSoft and Slack. - Marc Benioff”

Here’s CRM’s multiples compared to MSFT’s for comparison. Both start to re-rate post chatGPT. But remember: the macro environment is still tough.

Q1 results in May echoed much of the same thing.

“Before moving to guidance, I wanted to briefly touch on the current macro environment that Brian discussed. The more measured buying behavior persisted in Q1. And as Brian noted, in Q1, we started to see weakness in our Professional Services business. We expect these factors to persist, which is incorporated in our guidance. Let's start with fiscal year '24. On revenue, we are holding our guidance of $34.5 billion to $34.7 billion, representing over 10% growth year-over-year in both nominal and constant currency. The strength in our Q1 performance is offset by the pressure in our professional services business, as previously discussed.” - Amy Weaver

Q2 results in August still call out measured customer buying behaviour but the AI optimism is really starting to take hold within the company. They even raise guidance by a percent.

“And last quarter, we told you we're now driving our AI transformation. We're pioneering AI for both our customers and ourselves, leading the industry through this incredible new innovation cycle, and I couldn't be happier with Srini and David and the entire product and technology team for the incredible velocity of AI products that were released to customers this quarter, and the huge impact that they're making in the market and showing how Salesforce is transforming from being not only the #1 CRM, but to the #1 AI CRM, and I just express my sincere gratitude to our entire T&P team. I couldn't be happier with the performance of our team delivered in the second quarter. The numbers basically speak for themselves. Our AI, data, CRM plus trust platform, well, it's propelled us to become the third largest enterprise software company by revenue in the world. And I think in Japan, we just became the second largest company. So congratulations to everyone at Salesforce and especially to our Japanese team. And with our industry-leading cloud and sales service marketing commerce, our industry clouds powered by Data Cloud, Einstein, Flow, Tableau, Slack, MuleSoft. Really, all of these are integrated into one trusted metadata-driven platform. We're providing more capabilities to more customers than any other CRM vendor, and I can't wait to show all that, as I said, at Dreamforce. That's why Salesforce is the #1 CRM by market share based on the largest -- latest IDC software tracker. And now, we are working hard to be the #1, as I said, AI CRM.” - Marc Benioff

Before turning to guidance, I wanted to briefly touch on the current macro environment. As you heard from Brian, the measured macro environment continues to impact customer decision-making. And we are still seeing elongated sales cycles, additional deal approval layers and deal compression in our subscription and support and professional services businesses. These factors are incorporated in our guidance. Let's start with fiscal year '24. On revenue, we are raising our guidance to $34.7 billion to $34.8 billion, representing 11% growth year-over-year in both nominal and constant currency. The increase is driven by strength in our subscription and support revenue, particularly in MuleSoft. We are accelerating our transformation to profitable growth. - Amy Weaver

Customer behaviour still hasn’t changed in Q3, but it’s the first full quarter where this comparison is lapped, making future quarters “easier comps”. I’ll refrain from adding quotes here as it’s much the same as before.

Q4 results in Feb 2024 still came with a measured customer buying environment, but Salesforce’s results were slightly boosted by Data Cloud and MuleSoft wins as customers looked to move and integrate data to start experimenting with AI. Customers even bought premium SKUs that included Salesforce’s AI co-pilot Einstein. Shares continued to re-rate upwards as CRM was considered an AI winner. It also helped that the company saw improved bookings growth, meaning we’ve potentially hit the bottom on macro.

“We're excited by the momentum we're seeing in UE+ bundle, which is now called Einstein 1 edition. It's providing substantial returns for our customers and for Salesforce. In fact, we continue to see significant average sales price uplift from existing customers who upgrade to Einstein 1 edition. It's also attracting new customers to Salesforce. 15% of the companies that purchased our Einstein 1 addition in FY '24 where net new logos. As you heard from Mark, with our Einstein 1 platform, including Data Cloud and Einstein Copilot, we are rapidly infusing conversational AI across our entire product portfolio. Einstein 1 is a huge differentiator for us in the industry, transforming -- excuse me, as the industry transforms in this AI revolution. It's the fastest and safest way to unlock an organization's data to create better customer experiences, augment employees with AI and drive productivity and improve margins and profitability. Every AI strategy starts with data. As Marc said, Data Cloud has strong momentum. Data Cloud is approaching $400 million in ARR growing at nearly 90% year-over-year. And in Q4, 25% of our deals greater than $1 million included Data Cloud. Customers like Xerox and London Stock Exchange and Daikin turned to Data Cloud in Q4 to build their trusted data foundations and unlock their trap data within Salesforce. And we're excited about our future.

“We're just at the beginning of a new innovation cycle that will spark a massive software buying cycle over the coming years, and Salesforce is leading the way. We continue to see strong demand for our data products as customers lay the foundation for AI, specifically, MuleSoft is helping companies such as Rossignol and TK Elevator North America bring together their data from any source, a critical step to prepare for AI. MuleSoft was in 8 of our top 10 deals in the quarter and executed a record $319 billion workflows -- automated workflows every month, up 100% year-over-year. Tableau was in 20 of our top 25 deals in the quarter and is fully integrated to Data Cloud.” - Brian Millham

On revenue, we expect $37.7 billion to $38 billion, a growth of 8% to 9% year-over-year. A few items to note on the revenue guide. Our expectations incorporate a $100 million FX headwind year-over-year or a 30 basis point impact. We also expect our professional services business to remain under pressure in FY '25 and expect it will be a headwind to revenue. Within our revenue guidance, subscription and support revenue growth is expected to be slightly above 10% year-over-year in constant currency. As a reminder, our top line expectations include the impact from the measured buying environment that began back in fiscal year '23. This takes time to flow through our subscription revenue stream due to the lag effect of bookings to revenue recognition. That said, we continue to execute well in the measured buying environment. Over the past 2 quarters, I'm happy to say that we've seen improved bookings growth. And as you heard from Marc, we're incredibly well positioned to build on our success and bring our customers into this new AI era.

“Now to guidance for Q1. On revenue, we expect $9.12 billion to $9.17 billion, up 11% year-over-year in nominal and 12% in constant currency. This includes a headwind from the timing of license revenue in MuleSoft and Tableau. Additionally, Q1 has a 1 point benefit from an extra day of revenue recognition given the leap year, which has no impact on our full year revenue or cRPO. cRPO growth for Q1 is expected to be 11% year-over-year in nominal and 12% in constant currency.” - Amy Weaver

And here’s Marc and Amy answering a question related to “green shoots”. You can see Amy is reluctant to say there’s been an improvement in customer buying.

“It's a great question. And I think Amy will go back and say, it was really this kind of moment in the middle of fiscal year or whatever it was '23 where we started to see this kind of weird behavior. And then I would say, starting -- last quarter, like you said, we saw these green shoots, and now I would really say it was kind of a 180. It's really that AI, every customer realizes, number one, they've got to start a major investment cycle if they're going to remain competitive. Every customer is trying to achieve more productivity.” - Marc Benioff

“Sure. It's been an incredible couple of years. Marc, as you mentioned, going back to really the beginning of July in fiscal year '23, where we suddenly saw this measured buying environment, the elongated sales cycle, the additional approvals, the compressed deals. And over the last few years, what I've really seen is not so much a shift in the buying behavior, but a shift in our ability to execute. And I think we've seen that over the last couple of quarters, in particular, that we are just executing much better in that. I do think that there is a lot of excitement to come on AI and data, and we'll see how that plays out this year.” - Amy Weaver

Finally here’s Brian at the Q1 results.

“Now let me briefly address the buying environment. We continue to see the measured buying behavior similar to what we experienced over the past 2 years and with the exception of Q4 where we saw stronger bookings. The momentum we saw in Q4 moderated in Q1 and we saw elongated deal cycles, deal compression and high levels of budget scrutiny. In addition, in Q1, as part of our ongoing transformation, we made some intentional changes in our go-to-market organization to drive long-term productivity and create better customer experiences, which also played a role in the softer bookings performance. At the same time, we are seeing strong momentum in various parts of our business, particularly Data Cloud in industries. And we continue to drive our core growth levers. Multi-cloud deals, again, were a highlight for us in the quarter with 6 of our top 10 deals, including 6 or more clouds, showing the depth and relevance of our portfolio.” - Brian Millham

The weaker bookings performance in question was the Q1 9.5% growth in cRPO compared to the 11% guide from Q4 and Q2 guide of 10% in constant currency versus 10.5% street expectations. You wouldn’t have thought that those numbers would cause a 20% decline in the stock but it did. Somehow this was enough for those fintwit narratives to form. Here are some more off-calendar reporter’s quotes.

From Veeva’s prepared remarks

For fiscal year 2025, we now expect total revenue between $2.700 and $2.710 billion. This is a roughly $30 million reduction compared to our prior guidance, mostly in the services area. As we have said, the macro environment remains challenging as the industry continues to navigate inflation, higher interest rates, global conflicts, political instability, and the Inflation Reduction Act. There is also some disruption in large enterprises as they work through their plans for AI.

These challenges, along with customer-specific factors, have caused more of our R&D opportunities, particularly in top 50 biopharma, to align with Q4 rather than Q2 and Q3. And in the SMB segment of R&D, the effect of high interest rates continues to depress spending and cause some smaller companies to scale back, consolidate, or cease operations.

And Peter Gassner answering an analyst’s question in relation to the AI disruption

Let's see. So the first part of it is the disruption, what we mean by that. So if you look at a year or so, a little more than a year ago, AI really burst upon the scene with GenAI. And that causes -- it became very accessible. You saw it on 60 minutes. You could log on and try it yourself. It could answer a question. So that caused a lot of pressure in our larger enterprises, on the IT department, "Hey, what are we going to do about GenAI? What's our strategy as a large pharmaceutical company, biotech about AI?" And that we would land in the IT department of these companies. Now for the smaller -- our smaller SMB customers, doesn't land so much. They have other things to think about, other more pertinent, very stressful things. But in the large companies, with tens of thousands of people, they're looking for these operational efficiencies that they could potentially get through AI and they have a budget to kind of get ahead of that game. So that -- by the word disruption, I meant that through a competing priority into our customers, hey, we had some existing plans. Now this AI, we have to plan for what we're going to do on that. Where are we going to spend on innovation, on experimentation? Who's going to do that? What budget would we use, that type of thing. So some of that would take an impact onto us, which is core systems. Now those core systems, when we get that type of impact, it will delay a project, but it won't stop it because these core systems are things you need. You can delay them, but all that does is create somewhat of a pent-up demand. I guess, Rishi, there was a good parallel list with COVID, the pandemic a few years ago. That created a whole different set of dynamics with vaccines and therapies and work from home, priorities, all types of things. That created a disruption, which then, okay, take the focus off of the core systems a bit, and then it came back again. So that's the first part. That's the answer there.

Here’s Dev from MongoDB answering a question related to macro impact

Yes. So we did see a macro impact because we essentially saw the impact across size, industry, geo and tenure. But what I'll say in contrast to the hyperscalers, like we believe the bulk of their growth across all 3 hyperscalers was really spent on reselling GPU capacity because there's a lot of demand for training models. We don't see a lot of, at least today, a lot of AI apps in production. We see a lot of experimentation, but we're not seeing AI apps in production at scale. And so I think that's the delta between the results that the hyperscalers produce versus what we are seeing in our business. Our relationship with the hyperscalers is actually very strong. We partner very closely with AWS, Azure and GCP in the field; and in fact, they're coming to us to partner on deals more frequently than we've seen in the past. And our win rates, frankly, are very high. So we don't see any issues where we're losing deals to any particular vendor whether they're the hyperscaler or a small independent company. And so from that point of view, we think this is more macro related and the trend of a lot of people investing in the GPU infrastructure layer as well as training of models.

I would say, obviously, based on expectations, the macro was -- the consumption was worse than we had expected when we guided at the end of Q4 based on our Q4 results. And the reason we firmly believe there's a macro impact is because we saw that slowdown happen across different sizes of customers, across different industries, across different geos and also across the tenure of our customers. There's also -- the usage growth was definitely slower compared to a year ago period. So that's what gives us a belief that this was a macro issue. And then the new business issue was really -- as I said, we almost caught up, but it was really operationally getting our organization in place and quotas in place, and we definitely learned from that and we have changed our planning process so that we don't repeat the same mistake again. But that was the execution issue that I would say that we went through in Q1 with a slower start to the year.

So what to make of all this?

Software is still experiencing a cautious customer buying environment from two years ago as there are macro impacts of inflation, higher rates etc.

Q4 was abnormally strong because of a budget flush, which gave management teams false optimism that things were getting better, leading to less conservative guides.

Cautious buying environments mean that IT budgets are still being scrutinised and so any new AI-related spending is being taken from lower priority projects.

We are still in the early stages of AI spending, which only benefits companies serving the lowest layers of infrastructure (GPUs, hardware, servers, data centres and GPU-rental aka hyperscalers and maybe data-related infrastructure software piping).

Software companies do have terminal value, and recent price moves were just a violent reversal of valuation multiples re-rating from AI-optimism.

This is a free publication but if you’d like to support my work, please consider buying me a coffee.

Everything is an ad network…

This phrase is getting exhausting at this point and just when you start to think there isn’t much left to be monetised, something new pops out of the woodwork. In this case, it isn’t too unexpected given it does make sense.

From the WSJ

PayPal hopes to boost its growth by starting an ad network juiced with something it already owns: data on its millions of users.

The digital payments company plans to build an ad sales business around the reams of data it generates from tracking the purchases as well as the broader spending behaviors of millions of consumers who use its services, which include the more socially-enabled Venmo app.

PayPal has hired Mark Grether, who formerly led Uber’s advertising business, to lead the effort as senior vice president and general manager of its newly-created PayPal Ads division. In his new role, he will be responsible for developing new ad formats, overseeing sales and hiring staff to fill out the division, he said.

PayPal in January introduced Advanced Offers, its first ad product, which uses AI and the company’s data to help merchants target PayPal users with discounts and other personalized promotions.

Advanced Offers only charges advertisers when consumers make a purchase. Online marketplaces eBay and Zazzle have begun testing it, according to a PayPal spokesman.

But PayPal now aims to sell ads not only to its own customers, but to so-called non-endemic advertisers, or those that don’t sell products or services through PayPal. Those companies might use PayPal data to target consumers with ads that could be displayed elsewhere, for instance, on other websites or connected TV sets.

PayPal processed 6.5 billion payments by approximately 400 million customers in the first quarter, according to its most recent earnings report.

“If you’re someone who’s buying products on the web, we know who is buying the products where, and we can leverage the data,” Grether said. Consumers who use the PayPal credit card would also provide the company with data from real-world bricks-and-mortar stores, he added.

Shoppers would by default have their data included in the new network, but they can opt out, according to the PayPal spokesman.

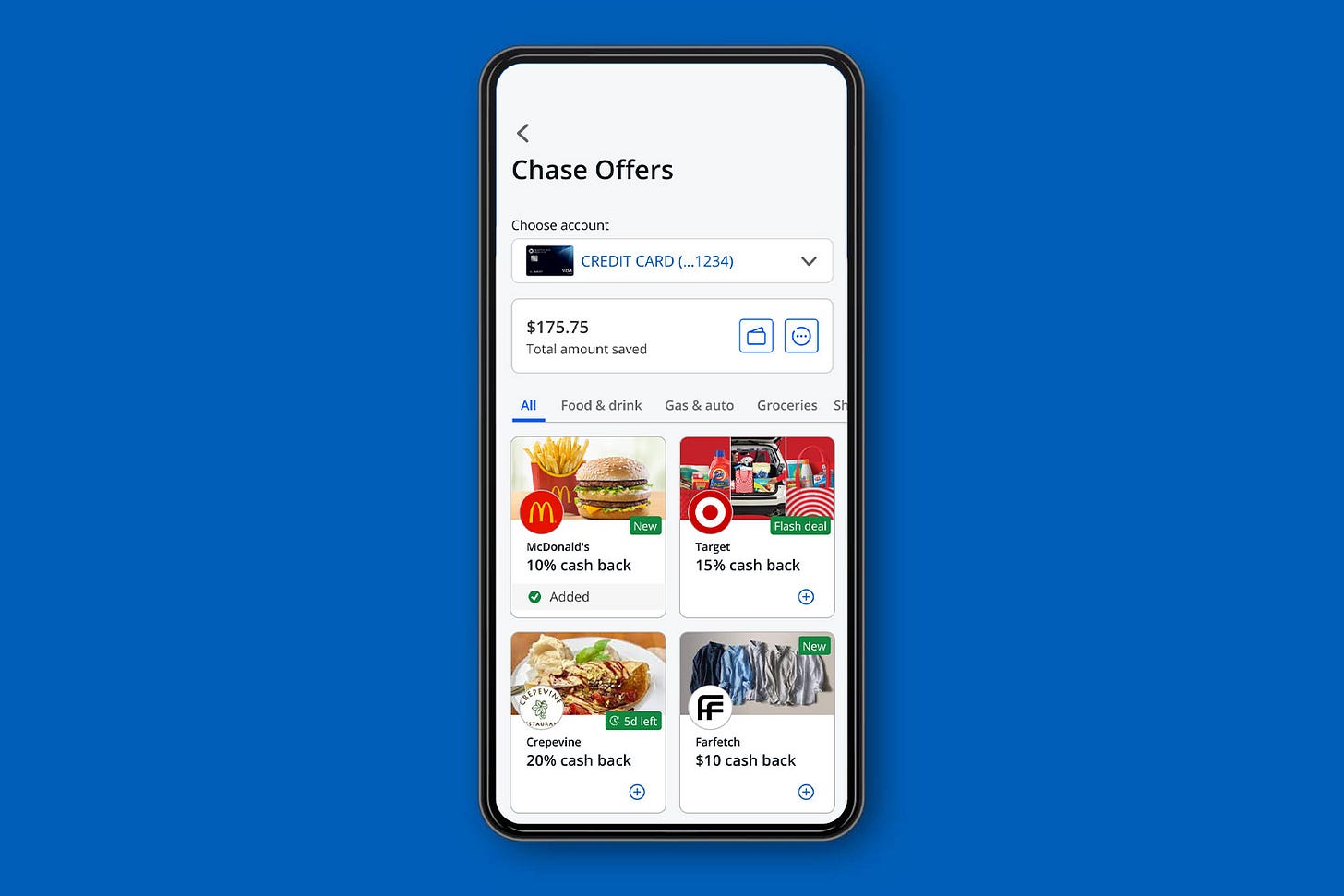

It will be intriguing to observe the company's success in this venture, given that PayPal's user engagement on its apps does not match that of other internet companies. While they might have the purchase data, they still require users to open the app, view the ads, and make purchasing decisions for advertisers to see a return on investment. Uber has built a roughly $1 billion ad business, which spans both Mobility and Eats, with the latter seeing greater buyer intent. PayPal's ad product might be more similar to what Cardlytics offers to banks within their apps.

Saturated sponsored ads

Related to ads, this Bloomberg article may suggest that sponsored ads on Amazon have been saturated.

Great Oral Health has been selling dental products on Amazon.com Inc. for almost a decade, buying ads from the e-commerce giant to help it stand out on the sprawling marketplace. But lately, the company noticed that spending more on Amazon ads was doing little to drum up new business.

So it turned to another well-known advertising company: Alphabet Inc.’s Google.

Shoppers find Great Oral Health’s ads on Google when researching solutions for bad breath, gum disease and other maladies. The results direct them to the company’s oral probiotic on Amazon, which actually pays merchants to lure customers from other sites because it would rather keep the business than lose it to Walmart.com or another competitor.

Amazon merchants have long used Google to drive shoppers to their own websites, with mixed results. Now new third-party software is helping them direct Google searchers to Amazon where they’re comfortable shopping. Sellers say the technique is boosting sales and improving their profits because Google ads are typically cheaper than Amazon’s. The credit Amazon pays for external traffic – typically 10% of the product price — sweetens the deal.

“Amazon knows Google is a monster and all shoppers are walking in those corridors,” said Ryan Duminy, a consultant with Bullseye Sellers who manages advertising for Great Oral Health.

Amazon has been selling ads for more than a decade, despite initial fears that doing so could muck up the shopping experience. Today, the Seattle-based company is a major industry player, generating $47 billion in advertising revenue last year. But it has become increasingly difficult to stand out on Amazon’s cluttered web store, prompting sellers and brands to search for marketing alternatives.

Google, which has long struggled to become a shopping destination, is only too happy to help. In an effort to attract inflation-stung consumers, the search giant rolled out a deal-finding tool in the fall. Earlier this month, Google said it is beta-testing new features that let brands upload short videos to appear in their Google search results.

But what really changed the game for Amazon sellers is the emergence of startups like Toronto-based Carbon6 and Seattle-based Ampd, which developed algorithms adept at mining Google queries for shoppers itching to buy. Searchers can be targeted by age, marital status and income, metrics that can be used to calculate the likelihood of them making a purchase. The software also filters out information seekers, who may not be ready to pull the trigger.

Online marketplaces are generally considered to reach a plateau in their advertising revenue at around 5% of their Gross Merchandise Value (GMV). According to calculations by Intentwise, which utilized GMV estimates, Amazon reached this saturation point in 2021. However, the company's advertising revenue exceeded the 5% threshold, likely attributable to the launch of its demand-side platform in 2019. This platform enabled advertisers to place ads across a wide range of channels, contributing to the excess revenue above the typical saturation level.

It is understandable that merchants would explore other advertising platforms to generate demand, given the limited inventory space on marketplaces. While digital shopping pages may not have a limit on eye-level shelves like brick-and-mortar stores, consumers only tend to focus on the first few pages during online shopping. Low margins mean there's a cap on how much a merchant is willing to spend to secure this top spot before the return on investment becomes unfavourable. Hence, merchants need to seek alternative avenues to drive demand for their products. Amazon's practice of crediting merchants for traffic generated from Google makes it an attractive option. Another interesting point raised in the article is the rise of search engines as the starting point for consumers' shopping journeys. Traditionally, marketplaces have been the go-to destination when looking to purchase goods, making them prime real estate for advertising. Ironically, as Amazon's search results are increasingly filled with sponsored listings, it may be losing its position as a trusty aggregator of affordable and reliable products, leading consumers to turn to search engines for comparative shopping. While this is a single data point, it will be interesting to observe how this trend evolves.

TikTok pausing its global e-commerce push again

From Bloomberg

TikTok has put on hold plans to launch its fast-growing e-commerce business across major European markets, focusing instead on growth in the US where it’s fighting a divest-or-ban law.

ByteDance Ltd.’s social media startup has put on hold a rollout of its shopping platform across Spain, Germany, Italy, France and Ireland that was to have taken place as soon as July, according to people familiar with the matter. It also iced plans to bring the Shop feature to Mexico and Brazil, one of the people said. It’s unclear if or when ByteDance may choose to resume the process, the people added, asking they not be identified discussing private information.

The move, which may catch many merchants in the region by surprise, reflects ByteDance’s objective of entrenching itself in the US as a way to prove its value to domestic merchants and consumers. ByteDance’s leadership wants to concentrate on its most lucrative market — with 170 million monthly users — to thwart a potential US ban that’s discouraged some merchants from signing up for the new platform, the people said.

A TikTok spokesperson declined to comment on the paused rollout plans and said the company is “guided by demand.” “We’ve seen the positive impact of TikTok Shop, and we’re excited to continue experimenting with this new commerce opportunity,” the spokesperson said.

It’s set a goal to grow US merchandise volume tenfold to as much as $17.5 billion this year. Importantly, management also recognizes that a full-on European expansion could invite regulatory scrutiny similar to the US, the people said.

This isn’t the first time the company’s scaled back a global launch. The FT reported in July 2022 that the company abandoned its plans to expand its live ecommerce initiative in Europe and the US after it struggled to gain traction in the UK. Now with the ban in the US signed into law, the company seems to be struggling to sign up merchants onto its platform due to uncertainty. Considering how lucrative the US market is for them, it's not surprising they've decided to focus their efforts (and resources) there in an attempt to salvage the business. To me, this suggests the company may be facing capital constraints, which could potentially benefit its e-commerce competitors globally.

That’s all for this week. If you’ve made it this far, thanks for reading. If you’ve enjoyed this newsletter, consider subscribing or sharing with a friend.

This is a free publication but if you’d like to support my work, please consider buying me a coffee. I welcome any thoughts or feedback, feel free to shoot me an email at portseacapital@gmail.com. None of this is investment advice, do your own due diligence.

Tickers: CRM 0.00%↑ , MSFT 0.00%↑ , MDB 0.00%↑ VEEV 0.00%↑ , PYPL 0.00%↑ , AMZN 0.00%↑ , GOOG 0.00%↑ , TikTok