Another chatbot, economics of LLMs and Amazon's confusing battle with PDD

30 June 2024 | Issue #25 - Mentions $AAPL, $META, $GOOG, $MSFT, OpenAI, $AMZN, $PDD

Welcome to the twenty-fifth edition of Tech takes from the cheap seats. This will be my public journal, where I aim to write weekly on tech and consumer news and trends that I thought were interesting.

Let’s dig in.

Privacy still matters for Apple

Just a day after I wrote about a potential Apple-Meta AI collaboration last week, it seems I might have jumped the gun. According to Mark Gurman at Bloomberg, someone with knowledge of the matter has swiftly denied these rumours.

“Apple decided not to move forward with formal Meta discussions in part because it doesn’t see that company’s privacy practices as stringent enough, according to the people. Apple has spent years criticizing Meta’s technology, and integrating Llama into the iPhone would have been a stark about-face. Apple also sees ChatGPT as a superior offering. Google, meanwhile, is already a partner for search in Apple’s Safari web browser, so a future Gemini deal would build on that relationship.”

BusinessInsider served up a good recap this week, detailing the long-standing feud between Tim Cook and Mark Zuckerberg. Revisiting this history really drives home how groundbreaking an Apple-Meta AI partnership would have been. This context makes Apple's swift denial of the rumour even more understandable.

Google’s chatbots

Google wants chatbots that people can hang with—not just pelt with questions.

The search engine giant has been developing a product for creating and conversing with customizable chatbots, which could be modeled on celebrities or made by users, two people with direct knowledge of the project said. The bots would be similar to the online personalities from Meta Platforms and startup Character.AI, based on celebrities like football star Tom Brady and TV character Tony Soprano.

Staff have discussed launching the new chatbots as soon as this year, one of the people said. The plans, which haven’t been previously reported, speak to how tech giants are looking for ways to turn breathtaking advances in generative artificial intelligence into apps that can keep consumers hooked.

Google spokesperson Justin Burr said, “Google Labs is a place where we experiment with future AI product ideas—some of which may be integrated into our products at some point, some of which will not.” He declined to comment directly on the chatbots.

Google's dipping its toes into the chatbot world seems like a smart move, even if their track record for supporting new products is a bit spotty. As we potentially head into a new era of exponential AI growth, this experiment makes a lot of sense. Google's bread and butter is still ad revenue from search, and while they're showing that AI-enhanced search isn't hurting their golden goose, there's still a question mark over where searches will start in the future. Gen Z is already turning to Instagram and TikTok for local recommendations, so it's not a stretch to imagine chatbots becoming the go-to for advice and suggestions in other areas. That's certainly what Meta's banking on, with Zuckerberg hinting at potential ad placements or premium AI assistants in their latest earnings call.

Character.AI's rapid rise is pretty eye-opening. Launched just in 2022, they're already handling 20,000 queries per second - about 20% of Google Search's volume. Sure, it's not quite apples-to-apples given the chatty nature of these interactions (for perspective, WhatsApp sees 1.6 million messages flying around every second globally), but it does highlight the potential for tech giants to monetize a new platform. For Google, it's a smart way to plug any leaks in their search engine revenue bucket.

Economics of AI models

The Information had a good article out on detailing some of the financials from the Microsoft - OpenAI partnership. Key snippets below

ARR figures

As of March, OpenAI was generating around $1 billion in annualized revenue from selling access to its models, according to someone who viewed internal figures related to the business. The annualized revenue rate refers to the prior month’s revenue multiplied by 12. In contrast, Microsoft’s comparable offering, Azure OpenAI Service, only recently hit $1 billion in ARR, OpenAI CEO Sam Altman told his staff this month.

How Microsoft benefits from the partnership

In the long run, though, Microsoft stands to gain from OpenAI’s success in other ways. Microsoft can use OpenAI’s technology in perpetuity for its own products. And after OpenAI pays back its first investors, Microsoft will get 75% of OpenAI’s profits until its principal investment—$13 billion—is paid back, and 49% after that until it hits a theoretical cap. The cap could soon rise, too.

Even when Microsoft loses a sale to OpenAI—Klarna and Salesforce are among the big clients that have cut deals directly with the startup—the software company doesn’t come away empty-handed. OpenAI pays Microsoft to run its AI business in its Azure data centers, plus it pays a 20% commission to Microsoft on API sales.

Gross margins from API sales

It’s a lot more lucrative for Microsoft to sell OpenAI’s tech to businesses than to merely collect cloud-server rental revenue from OpenAI, which initially pays Microsoft just enough to cover the cost of the Azure compute power OpenAI uses, according to a person who has direct knowledge of the arrangement. (OpenAI separately pays a commission to Microsoft later on.)

By contrast, Microsoft’s gross profit margin on the Azure OpenAI Service is around 40%, according to someone with direct knowledge of the business. That figure has improved over time as the AI models have become more efficient, this person said.

Given the reduced price OpenAI pays to use Microsoft’s servers, OpenAI’s API business could generate a similar margin.

Co-pilot has yet to make a material impact

While Microsoft has an advantage because millions of companies pay for Office 365 applications, and it has said 60% of Fortune 500 companies are paying for Copilot, that edge has yet to show up in its financials. In fact, enterprise sales growth of Office apps decelerated by 2 percentage points between the fourth quarter of 2023 and the first quarter of this year.

The article cleared up a misconception for me about OpenAI’s model availability. I had initially believed it was Azure-exclusive. AWS customers can actually buy directly from OpenAI, though it may come with less data privacy than if it was hosted with Azure.

To win deals, Microsoft is leaning on its biggest strength: bundling. Chief Marketing Officer Takeshi Numoto, who is in charge of the company’s cloud bundling strategy, has repeatedly questioned Azure leaders this year about whether they can “pull through” customers of Azure OpenAI Service to also spend money on other Microsoft products.

One challenge is that many Azure OpenAI Service customers, such as Intuit, primarily use services from rival cloud providers like Amazon Web Services, according to multiple Microsoft employees and several customers of the Azure service.

Expedia, for instance, buys models from OpenAI directly rather than from Azure in part because it uses AWS for most of its cloud services, and because OpenAI’s customer service seemed more “nimble,” Senior Vice President Rajesh Naidu said.

He added that the company was still open to switching to Azure in the future.

This is a free publication but if you’d like to support my work, please consider buying me a coffee.

Amazon getting into discounted goods

From The Information

Amazon plans to launch a section on its shopping site featuring cheap items that ship directly to overseas consumers from warehouses in China, according to slides shown to Chinese sellers, marking the e-commerce giant’s most aggressive response yet to the growth of bargain sites like Temu and Shein.

The new marketplace will offer unbranded fashion, home goods and daily necessities, according to the slides, and orders will take 9 to 11 days to get to customers. Amazon told Chinese sellers in a recent closed-door meeting that it would start signing up merchants this summer and begin accepting inventory in the fall.

Temu and Shein have seen enormous growth with U.S. shoppers in recent years by offering eye-wateringly cheap prices on goods that ship directly from China. That has sparked debate within Amazon, which has long touted speedy shipping times from its massive U.S. fulfillment network, on how to best respond, The Information previously reported.

An Amazon spokesperson said: “We are always exploring new ways to work with our selling partners to delight our customers with more selection, lower prices, and greater convenience.”

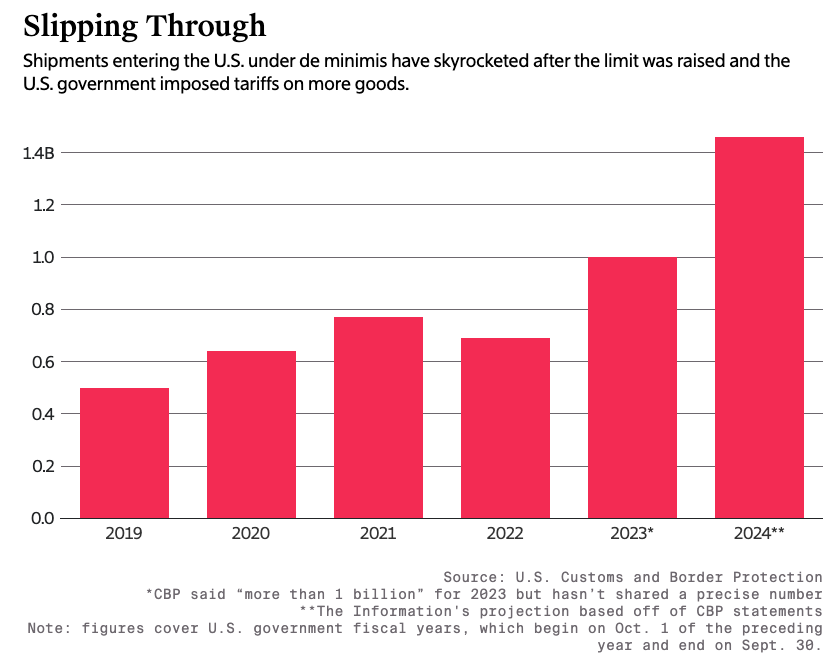

Another article from The Information goes on to report that the company will be using the same de minimis trade loophole to avoid paying custom taxes and duties.

Amazon is planning to use the same controversial trade rule as Temu and Shein to import items sold on its upcoming discount section without paying duties, according to a person close to the Amazon team working on the project.

While the expected move will help Amazon offer prices that are more competitive with its ascendant rivals, it’s also likely to thrust Amazon into the center of heated political debate around the trade rule. The rule exempts individual packages worth less than $800 from tariffs and has been critical to the rise of Temu and Shein.

Using the trade rule would be a switch for Amazon from its traditional practice of encouraging merchants that sell on its site to send items in bulk to its U.S. warehouses, where it could deliver them quickly to shoppers, often in two days or less. Chinese merchants selling on the new bargain section of Amazon’s website, however, will store goods in warehouses located in China, and Amazon will then send them directly to shoppers via air freight.

That means individual packages to Amazon shoppers won’t be subject to tariffs as long as they are valued at $800 or less.

If Amazon goes ahead with these plans, it would join other U.S-based e-commerce sellers that are increasingly finding ways to use cross-border shipments to avoid tariffs and offer lower prices to shoppers. Amazon’s deliveries on its new bargain-section items will take up to 11 days, while fulfillment will cost merchants up to 45% less than its existing fulfillment service, according to a presentation given to Amazon sellers.

Shein and Temu are the highest-profile online sellers sending goods to the U.S. duty-free, making up nearly 30% of packages shipped under the exemption, known as de minimis, a U.S. congressional committee report said in 2023. Out of all such shipments, nearly half came from China, according to the report.

The Information wrote an excellent article detailing the trade ‘loophole’ here. The TLDR is basically that companies are able to save on import duties and taxes (sometimes over 20% of the value) by shipping sub-$800 goods directly to US consumers from abroad, or by sending them in bulk to the US, quickly exported out of the country to Mexico or Canada, and then sent to the consumer from there.

Source: ExamineChina

This context helps explain Amazon's sudden interest in cross-border e-commerce. But why now? They've been aware of Temu's threat for over a year, wrestling with how to respond. Temu's growth has been nothing short of explosive, skyrocketing from $400m to $16bn in GMV from 2022 to 2023, according to JPM's estimates. The game-changer was Temu's semi-managed model launch in mid-March. While they could always offer cheap Chinese goods, delivery times were sluggish - up to 10 days. The new model kept pricing, customer service, and marketing in-house but outsourced logistics to Chinese sellers with overseas warehouses. This opened the floodgates for pricier, bulkier goods with halved delivery times. The kicker? Most of these Chinese sellers were already on Amazon.

Indeed, the number of China-based merchants on Amazon’s marketplace has exploded in recent years, swelling to more than a million today from less than 15,000 a decade ago, according to a person with direct knowledge. Almost half of the top third-party merchants on Amazon are based in China, according to estimates by Marketplace Pulse. The biggest of those sellers are paying Amazon to pack and ship their orders from its vast network of warehouses in the U.S. and Europe—an investment in infrastructure it can’t afford to squander by encouraging too many of them to ship directly from China.

JPM estimates Chinese sellers to account for 42% of 3P marketplace GMV.

Amazon's venture into cross-border goods could shake up its marketplace business significantly. The company's 3P take rates have climbed over time, encompassing sales commissions, warehouse fees, and advertising. Non-negotiable commissions typically hover around 15%, varying by category.

Generally, items from Chinese sellers on Amazon mirror those on Temu, but with a hefty markup. This premium covers faster shipping (thanks to Amazon's warehouses), Amazon's fees, and a tidy profit for the merchant. Amazon's new discounted goods section might cannibalize sales, with merchants likely taking the biggest hit. While Amazon benefits from its engaged consumer base (resulting in lower S&M spend) and efficient in-house logistics, it's ceding pricing control to merchants. This move could potentially attract more consumers than Temu, but it might also steer market forces away from Amazon's lucrative U.S.-based 3P business.

Additional headlines

Uber and Lyft Agree to Give Massachusetts Drivers Minimum Pay

Uber Is Locking Out NYC Drivers Mid-Shift to Lower Minimum Pay

Waymo Launches Driverless Ride-Hailing Service in San Francisco

That’s all for this week. If you’ve made it this far, thanks for reading. If you’ve enjoyed this newsletter, consider subscribing or sharing with a friend

This is a free publication but if you’d like to support my work, please consider buying me a coffee. I welcome any thoughts or feedback, feel free to shoot me an email at portseacapital@gmail.com. None of this is investment advice, do your own due diligence.

Tickers: AAPL 0.00%↑ , META 0.00%↑ , GOOG 0.00%↑ , MSFT 0.00%↑ , OpenAI, AMZN 0.00%↑ , PDD 0.00%↑