Pricing, AI and Nvidia over-earning?

23 July 2023 | Issue #2 - Mentions $NVDA, $MSFT, $CSU, $GRAB, $SE, $GOTO, $META $GOOG, $SPOT, $SQ, $V, $MA

Welcome to the second edition of Tech takes from the cheap seats. This will be my public journal, where I aim to write weekly on tech and consumer news and trends that I thought were interesting.

Through an investing lens, I break down and analyze these topics, providing valuable insights in a concise format.

Let’s dig in.

Cloud capex and demand for Nvidia GPUs

A thought I’ve been pondering for a while is the likelihood of a pull forward in demand for GPUs (disclaimer: I am no semis expert, just a sucker for contrarian bets). We know that Nvidia surprised everybody to the upside when they released their Q2 guidance for revenue to be $11bn or >50% above consensus estimates of $7.2bn. This sent the stock on a tear since its result in May 2023 (+55%), adding on top of its already monster performance in the year to date, now up 231%. Of course, this also led to general enthusiasm in the broader market too - the Nasdaq is up 16% since Nvidia reported.

So, this got me wondering - is this incremental demand that will continue into the years ahead due to an increase in AI/ML related workloads? Or is this capex that was supposed to happen over 3 years but instead has been pulled forward to accelerate research into AI while it’s topical?

We can see from FactSet Consensus numbers as of 19th July that the street expects Datacenter revenue to have a permanent step change up from $15bn in FY23 to $30.8bn in FY24 (105% yoy) and then 37% in FY25 and 19% FY26. This compares to the estimates of an increase of 20%, 29% and 28% respectively as of 23rd May 2023 (before Nvidia’s result & guide).

Consensus as of 19th July 2023

Consensus as of 23rd May 2023

So, expectations of revenue over the next three years went from a cumulative $70.8bn pre-results to $123.3bn post-results, an incremental $52.5bn.

Now, does this AI/ML hype warrant an extra $52.5bn in GPUs? or is the street mismodelling revenue going out three years on an absolute $ basis?

To dig deeper, we can look at capex spending intentions of the four ‘hyperscalers’ (Microsoft, Amazon, Alphabet and Meta), which although are estimated to make up ~40% of total industry spend on datacenters, are geared towards higher end server workloads that are more likely for AI/ML use cases than the rest of the corporations spending on datacenters. In aggregate, JPM expects 2023 data center capex for this group to increase 6% yoy in 2023 (+$6bn) and 8% yoy in 2024 (+$8bn)1. So, either there is some capex substitution going on (prioritising GPUs instead of CPUs), the demand is coming from elsewhere (not hyperscalers), or the street is wrong on demand for GPUs from hyperscalers.

This week, a piece from the Information helped shine a light on what’s playing out.

The demand for artificial intelligence chips is turning into a boom for several upstart cloud-server providers, thanks to the complicated politics of the tech industry.

Consider the case of one young cloud provider, CoreWeave. The company has received a generous allotment of the latest AI server chips from Nvidia, the dominant force behind ChatGPT and other AI apps, even though supply of those chips is limited. Nvidia has been diverting some of that supply away from the biggest cloud providers, including Amazon Web Services, because those companies are developing their own AI chips and want to reduce their reliance on Nvidia.

That has been great news for CoreWeave, which in recent weeks was on pace to generate more than $600 million on an annual basis, according to two people with direct knowledge, after it generated about $25 million in revenue in 2022.

Start-ups such as CoreWeave, Lambda Labs and Crusoe Energy have been cashing in on the AI hype by renting out GPU servers to other companies such as Stability AI, Inflection AI and even Microsoft Azure. (Interesting side note: CoreWeave used to be called Atlantic Crypto and made money by mining Ethereum using gaming GPUs). Is demand from these companies enough to plug the rest of the hole in incremental revenue modelled by the street? My guess is no, considering CoreWeave is projecting to generate $2.4bn revenue in 2024.

What about CPU substitution?

It’s possible, and Mark Liu, the Chairman of TSMC, basically said this in its latest earnings result, but the delta is still not big enough to account for the step change in GPU revenue, especially over the medium term.

“The short-term frenzy about the AI demand definitely cannot extrapolate for the long-term. Neither can we predict the near future, meaning next year how the sudden demand will continue or will flatten out. However, our model is based on the data center structure. We assume a certain percentage of the data center processor are AI processors. And based on that, we calculate the AI's processor demand, and this model is yet to be fitted to the practical data later on. But in general, I think our trend of big portion of data center processor will be AI processor is a sure thing. And will it cannibalize the data center processors? In the short-term, when the CapEx of the cloud service provider are fixed, yes, it will; it is. But as for the long-term when their data service – when the cloud service having the generated AI service revenue, I think they will increase the CapEx. That should be consistent with the long-term AI processor demand. I mean, the CapEx will increase because of generative AI services.”

AMD and Intel both supply CPUs for data centers

AMD consensus as of 19th July 2023

Intel consensus as of 19th July 2023

That brings me to my last point. Is the street too low on hyperscale capex estimates or too high on GPU demand?

My best guess is it’s somewhere in the middle.

Let’s take Microsoft, which this week announced details on how they’re going to price their generative AI tool for Office365, co-pilot.

Microsoft is to charge $30 a month for generative artificial intelligence features in its widely used productivity software, slapping a bigger premium than expected on a technology that many in the industry hope will bring a powerful boost to revenues.

For customers who sign up, the new features are set to add a hefty 53-83 per cent increase to the average monthly cost of business-grade versions of the Microsoft 365 service, a suite of software formerly known as Office 365 that is used by hundreds of millions of workers.

Satya Nadella, Microsoft chief executive, defended the pricing decision as part of a generational shift in technology that would bring a new dimension to one of the software company’s core products.

“I would think of this as the third leg” of Office, he said, after applications such as Word and Excel and cloud services like Teams. Speaking in an interview with the Financial Times, he claimed the new AI features “are the same class of value”, automating routine work and increasing productivity.

Shares were up 4% on the day or $110bn in market cap was added.

For CY23, Microsoft is expected to spend $29.7bn on capex, up 16% yoy. At the start of this year, this number was $28.5bn or $1.2bn lower. So since the boom in AI in the first half of the year, the street brought estimates up by $1.2bn.

With the pricing plan announcement we can start to run some napkin math on whether this spend makes sense, and what sort of returns they’ll get.

There are approximately 382 million people using Office365 (as of Apr-23) in the world (though UBS puts the actual serviceable addressable installed base at 160-180 million of premium O365 users). If we assume 10% of them opt-in for co-pilot in three years time (or ~22% penetration of premium users), that’s $13.8bn in incremental revenue for Microsoft or $4.6bn in net income using current margins of 33.3%. This is slightly higher than the implied earnings attributed to the $110bn increase in market cap on 32x NTM P/E and current margins.2

If we use CY22 capex as a baseline ($25.6bn) and assume estimated capex for the next 3 years on-top of $25.6bn is for AI workloads, we’ll have a cumulative $25bn in incremental capex (current CY estimates for MSFT capex are $29.7bn, $33.5bn and $38.6bn). That’s 18% ROIC - a commendable figure though nothing jaw-dropping. My take from this is that capex has little room to increase from current estimates, so it’s very possible that revenue estimates for Nvidia are too high. Of course where I could be wrong is if more than 10% of O365 users adopt co-pilot, or Microsoft deploys the compute for other higher returning use cases, but offsetting some of that is the capex it’s already spent over the last couple of years.

Special situations in Private Markets

I enjoyed this podcast with Jeremy Giffon on Invest like the Best, a former General Partner at Canadian Internet holding company Tiny. It’s filled with many bangers, timeless wisdom and is incredibly quote-able. Here’s one on how he finds new ideas/deals.

“Some of these are so good. I'm reticent to even talk about them because I know no one is doing them. An example is any time a large tech company makes an acquisition of another midsized company, there's almost always assets in there that need to get divested or the acquirer doesn't want. What's funny there and other misaligned incentives is the incentive of the corp dev or the acquirer is not at all related to maximizing price. What they want -- and what so many people want all the time in investing, it's just they don't want to hassle.

And fair enough, let's say, like Fortune 500 tech company buys a company for $500 million and they want to divest a $15 million asset. Does anyone get any credit for that $15 million sale? No, it doesn't move the stock price, it doesn't help the corp dev. No one gets anything for that. And so what's really wanted there is just make the poor corp dev guy's life easier. And so those are great. Another is sometimes start-ups have two product lines and one is working and one isn't.”

I happened to listen to this a day before Constellation Software (CSU) announced that its Perseus operating group will be acquiring Black Knight’s (BKI) Optimal Blue business. The deal is set to be for US$700m, made up of $200m in cash and the remainder financed by a promissory note issued by Constellation to Black Knight, as a subsidiary of Intercontinental Exchange (ICE). When you consider that BKI originally purchased 60% of Optimal Blue in 2020 at $1.8bn and the remaining 40% in February 2022 for $1.2bn, you’ll understand what an incredible deal this was. The context is that ICE agreed to buy Black Knight in May 2022 but was met with opposition from the FTC due to them “merging the country’s two largest providers of home mortgage loan origination systems”. This marks the second unit Black Knight has had to divest as a result of the deal (with the first being Empower in March 2023, also going to CSU.)

Bundling and unbundling

Jim Barksdale once famously said there are “only two ways to make money in business: one is to bundle; the other is unbundle.” This applies to every industry but in the age of the internet, this notion has taken on even greater significance. Whether it be Microsoft’s bundling of the Office suite, or the evolution of Craigslist into platforms like Indeed and Airbnb, these past two decades have been a playground for innovative disruptions.

The next industry to come full circle is looking to be Superapps.

“Singapore-based Grab and Indonesia’s GoTo spent much of the past decade in a dash to bundle consumer services from ride hailing to food delivery into a single app. Global investors pumped in money, betting on strong growth from the region’s tech-savvy consumers in the wake of China’s experience with superapps and a boost from pandemic-inspired demand for digital services.

But Nasdaq-listed Grab and Jakarta-listed GoTo have been forced into a retreat over the past 12 months, shedding thousands of jobs and cutting back marginal business units. Their share prices are more than 60 per cent below their listing price.

Rising interest rates are ending an era of cheap funding and forcing the cash-burning companies into a reality check on whether their business models will lead to profits, analysts said.”

Apps like WeChat and Meituan in China were pioneers to the concept over a decade ago. Their business models came with great allure - acquire a customer once and cross-sell as many products/services to them to increase their Lifetime Value in order to maximise LTV/CAC. I think it’s still a good concept, but the companies in Southeast Asia took the concept too far in the world of abundance.

Like, I wonder what the unit economics of this were?

“GoTo has also done several rounds of job cuts and scrapped several on-demand business lines such as GoClean and GoMassage, which brought cleaners and masseurs to customers’ doorstep.”

It’s promising to see the now-scaled internet conglomerates embracing a more rational approach and changing consumer expectations around subsidies, which will ultimately be good for the ecosystem in the long-run. It’s become a common theme across the industry.

“Slower growth is driven by the conscious decision we have made to weed out low-quality, subsidy-driven transactions as we calibrate our business for a future in which every user can be profitable,” - GoTo said in a statement.

MAS update

I wrote last week that Grab and Sea were lobbying the Monetary Authority of Singapore to review its stance on capping the companies’ digital banks deposits at S$50m.

This article from Bloomberg suggests they’ve been successful.

“GXS Bank, the digibank joint venture of Grab and Singapore Telecommunications Ltd., said Wednesday that customers can now each deposit up to S$75,000 ($57,000) into a savings account. The limit previously was S$5,000. Sea’s MariBank, the only other holder of a digital full bank license in Singapore, also raised its maximum for individuals to the same level effective from July 20, according to a statement sent to Bloomberg News.”

This positive development paves the way for a more dynamic and competitive landscape, fostering growth and innovation within the fintech sector. As these companies gain greater access to capital, they can better meet the needs of their customers and contribute to the advancement of financial services in Singapore.

Meta’s Commercial Llama

This week Meta announced that it was making a version of its LLM, Llama, freely available for commercial use.

“Mark Zuckerberg’s Meta is making a commercial version of its artificial intelligence model freely available, in a move that gives startups and other businesses a low-cost opportunity compete with OpenAI’s ChatGPT and Google’s Bard.

A new version of a Meta large language model (LLM), called Llama 2, will be distributed by Microsoft through its Azure cloud service and will run on the Windows operating system, Meta said in a blogpost, referring to Microsoft as “our preferred partner” for the release. LLMs underpin generative AI products like the ChatGPT chatbot, although ChatGPT’s owner has not open-sourced – or made widely available to others – its LLM, called GPT-4.

The model, which Meta previously provided only to select academics for research purposes, also will be made available via direct download and through Amazon Web Services, Hugging Face and other providers.”

There’s currently a lot of coverage on this, and this post has gotten way longer than I expected, so I’ll just link to a few pieces that I thought were good at articulating the strategy behind Meta’s choices.

Why did Meta Open-Source Llama 2 by Matt Rickard

Streaming Residuals and Spotify, Llama 2 Open-Sourced, Llama's License (Stratechery Update 7-19-2023) by Ben Thompson

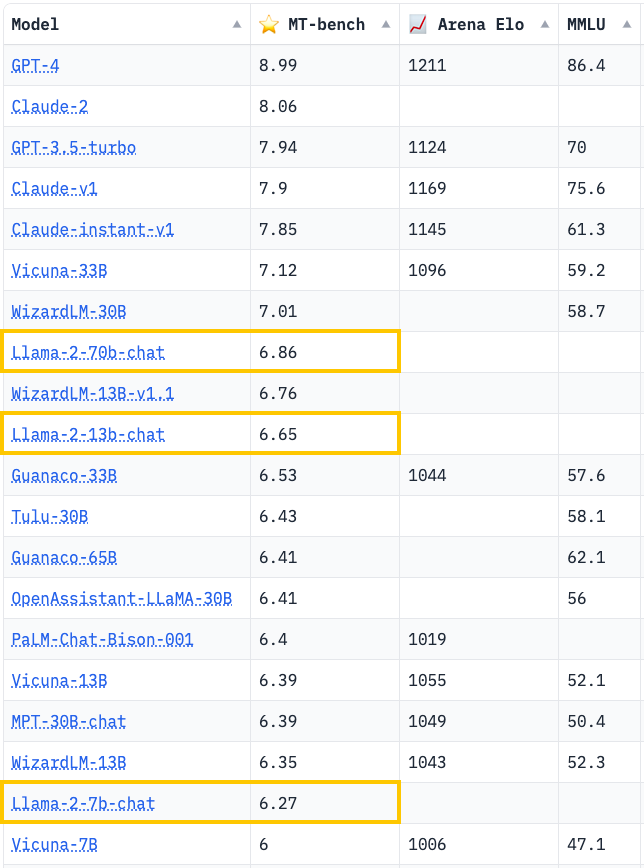

@lmsysorg on twitter did a helpful evaluation on the various LLMs available at the moment.

Everybody’s raising prices

Both YouTube and Spotify announced this week that they were raising the price for their streaming services.

“YouTube Premium’s price has increased to $13.99 a month in the US, a $2 increase compared to what it used to cost. That’s according to Google’s signup page for the service, which has been quietly updated to reflect the new pricing, as was first spotted by 9to5Google. Alongside the monthly price increase, the cost of an annual subscription to YouTube Premium is increasing by $20 to $139.99.

YouTube Music — the music streaming service that’s available standalone or as part of a Premium subscription — is also seeing a price increase in the US. It will now cost $10.99 a month, mirroring similar price increases we’ve seen for Apple Music, Amazon Music, and Tidal. Spotify is a notable holdout for still charging $9.99 a month, but CEO Daniel Ek recently indicated that the service is “[ready to raise prices](https://seekingalpha.com/article/4596364-spotify-technology-s-spot-q1-2023-earnings-call-transcript#:~:text=So it's a whole sort of set of discussions%2C and there's a number of different variables that go into them. And again%2C I think we're ready to raise prices. I think we have the ability to do that%2C but it really comes down to those negotiations.)” — suggesting a similar increase might not be far away.”

Spotify Technology plans to raise its monthly subscription price in the U.S. by $1, a long-awaited change by the audio giant as it pushes to become consistently profitable.

Under the planned change, expected to be announced next week, the cost of Spotify’s ad-free premium plan is likely to increase to $10.99 a month in the U.S. from $9.99, people familiar with the matter said. Other price increases are likely to roll out in dozens of markets globally in the coming months.

These price increases are indicative of two major factors: 1. streaming services are demonstrating continued rationality in their pursuit of profitability and 2. the rising costs of content production and acquisition.

“Spotify is by far the largest music streaming service by subscriptions globally, but has been a holdout among competitors, including Apple, Amazon and YouTube, that have raised their prices in established markets…

Audio and video streaming services alike are under pressure from Wall Street to focus on profitability over user growth. A number of video streaming services, including Peacock and Disney+, have raised prices in recent months.”

Investors seem to have expected the news, as shares were basically flat over the day and have been up 110% year to date. Unfortunately for Spotify (and other music streaming services) this price adjustment probably won’t drop straight to the bottom line as they have labels to share the proceeds with (who have been urging the companies to increase.)

“For years, music executives have urged streaming services to not only increase their basic monthly price, but also explore other pricing options and tiers to draw more paying users and, in doing so, create more of a windfall for labels and artists….

…Warner Music Chief Executive Robert Kyncl said on a May call with investors that Spotify would generate $1 billion in revenue by raising the price of its U.S. subscription by $1. Recent price increases by other companies are a move in the right direction but should just be the first step, he said.”

The revolution against market monarchs

A lawsuit dropped this week from Block suing Visa and Mastercard over egregious interchange fees.

Visa Inc. and Mastercard Inc. are facing a new antitrust lawsuit that alleges the credit card companies conspired to vastly overcharge the Square payment platform, causing higher retail prices paid by consumers.

Block Inc., the company formerly known as Square Inc., claims that Visa and Mastercard conspired to fix inflated “interchange” fees and maintain market power, according to a suit filed July 14 in the US District Court for the Eastern District of New York.

This case is definitely worth keeping an eye on, and Block are strategically challenging market power by arguing its impact on consumers. It’s not the first time that Visa and Mastercard have been sued over their fees, but it highlights the ongoing scrutiny over regulatory risks when investing in monopolies and duopolies. It’s also interesting from Block’s perspective - the bull case for the company was that it could create a closed loop between its Cash app and seller ecosystem and either keep the interchange fee for themselves or share in the benefits with its merchants. Shining a light on interchange fees perhaps suggests that the payoff may be greater/more likely by fighting to have the fees reduced.

That’s all for this week. If you’ve made it this far, thanks for reading. If you’ve enjoyed this newsletter, consider subscribing or sharing with a friend

Share Tech takes from the cheap seats

I welcome any thoughts or feedback, feel free to shoot me an email at portseacapital@gmail.com. None of this is investment advice, do your own due diligence.

Tickers: NVDA 0.00%↑, MSFT 0.00%↑ , CSU 0.00%↑ , GRAB 0.00%↑ , SE 0.00%↑ , $GOTO, META 0.00%↑ GOOG 0.00%↑ , SPOT 0.00%↑ SQ 0.00%↑ , V 0.00%↑ , MA 0.00%↑

Adding Oracle to this group increases 2023 aggregate CapEx by $1.5bn and decreases 2024 by $125m)

32x NTM P/E implies $3.4bn in net income, $10.3bn in revenue using a 33.35% net margin (LTM)