Shower thoughts on Threads, ecomm and travel comps

6 August 2023 | Issue #4 - Mentions $META, $GOOG, $SHOP, $MELI, $AMZN, $PYPL, $ABNB, $BKNG, $EXPE

Welcome to the fourth edition of Tech takes from the cheap seats. This will be my public journal, where I aim to write weekly on tech and consumer news and trends that I thought were interesting.

Through an investing lens, I break down and analyze these topics, providing valuable insights in a concise format.

Let’s dig in.

Has Twitter already saturated the market for text-based social media?

This post from @buccocapital on Threads got me thinking - maybe Twitter’s ~250 million monetizable DAUs is near the peak for text-based social apps. Worldwide Twitter users reached 368.4 million in 2022, a 6% CAGR since 2019 or a meagre 2% over the year prior1. Meanwhile, Mark Zuckerberg has recently shared that his goal for Threads was to reach 1 billion users - but what if there just isn’t that many people who are interested in consuming real-time publicly written content?

Instagram started its life in 2010 as a mobile app and only introduced a bare-bones web interface two years after its iOS-only launch (the app had 100 million registered users at the time.) It wasn’t until 2015 when it had over 300 million MAUs that it redesigned the desktop website to look consistent with its mobile website and app. Back then, users in the US spent an average of 14 minutes a day on the Instagram app. This compared to 7 minutes a day on the Twitter app. Fast forward to today, users spend closer to 30 minutes a day on the Instagram app, while spending 9 minutes a day on Twitter. When including time on the websites, Instagram is basically unchanged, but Twitter usage jumps to 35 minutes2.

Source: Statista 2023

One way to analyse why this may be the case is to think about the goals for logging into each platform (h/t @speedwell_research for the excellent podcast on Meta which mentioned this framework.) Instagram was created as a photo-based social media app where users followed friends, family and people they were interested in, and logged into the app to see updates on their lives. You open the app for social reasons, and you can respond to messages from friends. Over time they added more features such as the algorithmic feed, which surfaced posts in the order that IG thought you’d be most interested in first, rather than chronological, and then Stories, which allowed for disappearing photos and videos to be shared with your followers that wouldn’t permanently stay on your profile. Reels came next, which is a TikTok clone of short-form videos that are recommended based on interests. All that is to say, the goal for Instagram started off as social to keep in touch with friends and turned into an app you opened for entertainment - and so naturally the time spent on the app has increased over the years. Meanwhile, Twitter’s time spent on the app has stayed roughly flat, as its goal of staying current on news and events has remained fairly similar to what it’s been 8 years ago. So despite Instagram being consumed mostly on mobile, its total time spent on average is close to Twitter as a whole, while being multiples larger in scale.

Source: Statista 2015

To get to the 1 billion user mark on Threads, the app needs to be more than just a Twitter alternative, it needs the have another goal. The goal of Twitter is to stay current on the latest news and events in an open and public forum, so it needs a desktop site to stay logged on during the day at work. The fact that retention on Threads is being impacted via a lack of a desktop site suggests that it’s just another alternative. Meta is betting that the goal of Threads is less about being a text-based platform for current news and events and more about having two-way public conversations, while IG will be one-way. We will see if users agree.

This article on Every argues that Threads is about resetting the social graph and lowering the bar to posting, as IG has morphed towards an entertainment app with mostly influencers and content creators.

So Threads is a different approach. It’s a big reset of the social graph. You get to start over—using your Instagram following lists to decide who comes with you. It’s not that different from Instagram—you can post videos, photos, or text. The same stuff.

They created a Twitter-looking Instagram to increase engagement of Instagram users; they didn’t really make a Twitter competitor. But it’s not as sexy to say, “We’re trying to revive our inactive users.”

Just like with Stories, they’re looking for a new way to lower the bar for posting, so people lounging at home can still engage with the conversation online. Lockdowns through the pandemic weren’t suited for photos and videos. How many shots of yourself in loungewear on a bed watching Netflix can you post?

The rise of influencers also made it more intimidating to post. There’s a lot more competition for attention. When people tap the Instagram app the goal is no longer, “I’m going to share.” It’s: “I’m going to watch.” When my mom opens Instagram, most of what she watches isn’t her friends… because they’re boring.

This came out last weekend reporting on the inside story of how the Threads launch came to fruition while noting that retention for users on Android were a paltry 26% sixteen days after its high on 7th July. I’ve written in the past about having some perspective on the retention rate of new apps, but this report gives us further insight into how the management team is thinking about the strategy for the app.

To keep things moving, the Threads team punted thorny decisions and eschewed difficult features, including private messages and the ability to search for content or view the feeds of people you don’t follow. The company also opted not to launch in the European Union, where regulators are preparing to enforce new rules next year requiring tech companies to provide more information to regulators about their algorithms.

“You do the simple thing first,” Mosseri said. “And I think that also helps reduce the scope, because often what happens is scope creep and you want to add all these things because they’re all great.”

It wants to avoid boosting politics and other hard news on the platform as the extra engagement isn’t worth the scrutiny.

Meta hopes Threads can steer clear of the political quagmires that have made Twitter and other social media platforms so controversial. Mosseri stirred debate earlier this month when he said Threads would not actively “encourage” politics and “hard news,” because the extra engagement is not worth the scrutiny.

Meta’s president of global affairs Nick Clegg later elaborated in an interview ****that the company would likely not add specific news-focused product features, but would give more users control over what they see. Zuckerberg, for his part, has proudly welcomed some of his favorite mixed martial arts athletes to the platform.

But if Threads takes off, the company might find it impossible to avoid the sort of politically charged decisions that have made operating Facebook, Instagram and WhatsApp so challenging.

Some of Threads’ most influential early adopters were journalists and media organizations sharing the kind of breaking news that generates partisan reactions. Politicians such as Rep. Nancy Pelosi (D-Calif.), Rep. Alexandria Ocasio-Cortez (D-N.Y.) and several Republican presidential hopefuls, including Mike Pence, were also quick to join the platform.

Mosseri has previously posted on Threads that they weren’t going to introduce DMs because there were enough apps with DM functionality from the company between Messenger, WhatsApp and IG DMs, and they didn’t want to flood users with another inbox to manage - but that seems to have been reversed.

Threads’ unexpected popularity prompted Mosseri to cut short another Italian vacation last week to handle a deluge of requests and concerns from other Meta teams, such as communications and policy. He said he wants to keep the core Threads team insulated so they can focus on adding the features users expect from a full-service social app.

Asked what he sees as the key to Threads’ long-term success, Mosseri didn’t offer the sort of big-picture vision he has become known for at Meta. Instead, he pointed to four short-term priorities: helping users build their lists of people to follow, improving the algorithms that decide what users see, giving users a way to see posts only from people they follow, and figuring out how to let people message each other.

“Lots of basics like that really need to get fixed — and fixed quickly,” he said.

Five days after Mosseri spoke with The Post, Threads rolled out numerous new features, including a feed that shows users posts only from the people they follow.

Meanwhile, the internal excitement about Threads has validated advice Mosseri said he received from Instagram co-founder Kevin Systrom soon after Mosseri replaced him in 2018: Often, the best way to boost morale — even in a company battered by missteps and layoffs — is simply to deliver functional products.

They’re up against an incumbent with strong network effects and an extensive set of features, and they understand that in order to retain the users looking for an alternative that incorporating these basic features is imperative. Only then can they start to ‘pour on the gasoline’ to accelerate adoption as Mark Zuckerberg recently shared on the latest earnings call. What would that involve? Things like making it easier to cross-post on IG, push notifications to surface popular posts, etc. Of course, if Threads ends up flaming out then it might prove that network effects do exist on Twitter, which would also be positive for Meta’s core services. Seems like an asymmetric bet.

Meta bans the news in Canada

Meta Platforms started its process of ending news availability in Canada over a law requiring digital platforms to pay local news outlets.

The California-based company has followed through with its threat to block news on Facebook and Instagram. The move came after Prime Minister Justin Trudeau’s government passed the Online News Act, expected to come into effect before the end of this year.

Ben Thompson has written excellent takes on the overreach of government regulation, which blames aggregators for supposedly destroying news publication’s business models. Meta and Google services act as powerful distribution platform for publishers to share their content, while Meta has stated that links to news articles make up less than 3% of the content on its users’ feed. This stems from the government and publishers seemingly misunderstanding the flow of economic value. The news out of Canada follows a similar case in Australia a couple years ago.

I thought this paragraph in Ben’s article from 2021 describing the situation in Australia boiled the issue down perfectly.

Facebook, on the other hand, doesn’t unilaterally index news sites, and has its own source of content: its users. Not having news wouldn’t change the product in any substantial way, which makes it all the more ridiculous that the service was on the verge of being forced to pay for links created not by Facebook but rather by Australian news orgs and Australian citizens. The company was quite literally going to have to pay, say, The Australian for The Australian posting The Australian links on Facebook!

Meta and Google ended up striking a deal in Australia, but the situation in Canada seems to be worse for the two services.

The Canadian law is similar to a ground-breaking law that Australia passed in 2021 and had triggered threats from Google and Facebook to curtail their services.

Both the companies eventually struck deals with Australian media firms after amendments to the legislation were offered.

But on the Canadian law, Google has argued that it is broader than those enacted in Australia and Europe as it puts a price on news story links displayed in search results and can apply to outlets that do not produce news.

This comes at an interesting time for Meta especially due to their foray with Threads and its logical place as a platform to share the news. It comes back to figuring out what the goal for the app is, and perhaps Mosseri stating that the app wants to avoid politics and ‘hard news’ means the company thinks the goal is much broader than just keeping on top of current news and events.

Autonomous driving is hard

I thought this piece of news was interesting.

Waymo is pausing its efforts to develop autonomous truck technology to refocus on ridehailing services instead. The Alphabet-owned company announced today that it will “push back” the timeline on its commercial and operational efforts for trucking and will also be scaling back development in the unit. A small number of employees were laid off as a result of the decision.

When I was looking into the space a couple years back, autonomous trucks were a bright spot in the industry due to mainly operating on highways, which did not require as much complexity and nuance to train the AI compared to other environments (such as robo-taxis). Robo-taxis on the other hand, seemed to be challenged by trying to figure out the last few % of full autonomy.

Meanwhile, in California, state legislators will soon vote on a bill that would require real human drivers to be present at all times inside of autonomous trucks, which the industry said would be a death sentence for driverless trucks in the state. Experts previously predicted that self-driving semi trucks would become a thing before robotaxis since the technology and complications were thought to be much simpler.

It’s not clear whether this was a key decider on why they decided to push back to timeline, but if it was then it goes to show that even if technological advancements aren’t a roadblock there can be other factors at play that end up delaying adoption. Something to keep in mind when also thinking about enterprises and GenAI.

Related: Waymo One heads to Austin

AI Chatbots

From the Financial Times

Facebook owner Meta is preparing to launch a range of artificial intelligence-powered chatbots that exhibit different personalities as soon as next month, in an attempt to boost engagement with its social media platforms.

The tech giant led by chief executive Mark Zuckerberg has been designing prototypes for chatbots that can have humanlike discussions with its nearly 4bn users, according to three people with knowledge of the plans.

These people said some of the chatbots, which staffers have dubbed “personas”, take the form of different characters. The company has explored launching one that emulates Abraham Lincoln and another that advises on travel options in the style of a surfer, according to a person with knowledge of the plans.

The chatbots could launch as soon as September, the person said. Their purpose will be to provide a new search function and offer recommendations, as well as being a fun product for people to play with.

Mark Zuckerberg has hinted at the latest earnings call on the company’s plans for using its AI-related capex - and chatbots will be one of its consumer facing ones. Meta is in a decent position to take advantage of its ~4bn users across its family of apps to distribute the tool and collect data. If the recent success of ChatGPT (and subsequent decline?) is anything to go by, this could provide a (temporary?) boost to engagement and put the company in a unique position to grab a bigger slice of the top of funnel. Chatbots could create itineraries or suggest restaurants to eat at based on personal information that the company has already collected on individuals from its apps. Of course, if we were to use Meta’s previous history on monetisation as a guide, these bots may come with incremental computing cost without them adding much to the top-line. Let’s hope they stagger the release.

Covid hangover for ecommerce looks to be ending

This week had a number of ecommerce companies (notably SHOP, MELI & AMZN) report their June quarter which gave investors another data point to assess whether secular growth was back on the menu. GMV for the ecommerce group3 grew 12% on a (0.4)% comp a year earlier, accelerating from (1)% in Q1 on a 7% comp (out-growing the retail sales figures that came out for Q2). These companies went through a rollercoaster of a three-year period, pulling forward years of demand into 2020 and then suffering from a hangover a year later on the back of difficult comparisons (as people shifted spend to services), adding a cyclical element to the generally secular trend of retail commerce shifting to digital.

Source: company filings, FactSet

Source: US Census Bureau

Although it’s just a single data point, it’s positive that the two-year stack for the group has also accelerated from 6% in Q1 to 11% in Q2, giving further credence to the recovery story. This coincides with commentary from Meta and Google (that I wrote about) last week calling out strength in retail and online commerce, while PayPal noted similar trends in its latest earnings call.

Dan Schulman, PayPal CEO: … And as I mentioned in my remarks, we're clearly seeing a lot of headwinds begin to shift towards tailwinds. E-commerce is definitely one of those. We see e-commerce growth accelerating. We think it is at least in the mid-single-digits right now. That's substantially above what we thought when we entered the year, when we thought it might be flat year-over-year. And I would say, we've got a slight bias that that will continue to accelerate. You've got a range out there from low zero to high of 10%. We think it's probably right in the middle of that, and we think it is being driven by a shift from travel and services into goods, into fashion, more coming into retail. Pieces of that. And clearly as inflation cools, we would expect to see more discretionary spend rebound and that will help drive e-commerce.

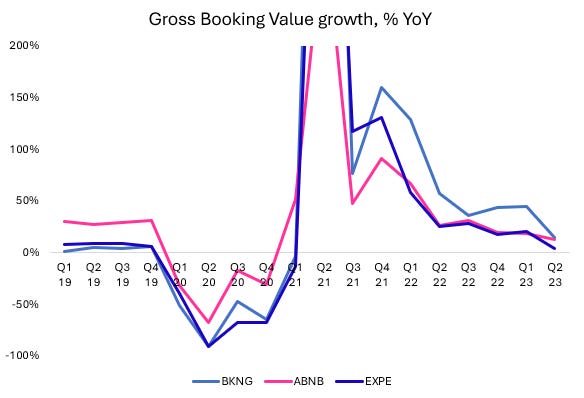

No travel hangover yet

The three major Online Travel Agents also reported results this week with Airbnb, Booking and Expedia generally reporting decent numbers, a similar trend to results from other travel and leisure companies mentioned in last week’s post. After a couple of strong years of pent-up demand from consumers wanting to travel, investors have been wondering at what point these tailwinds become a headwind to growth due to tougher comps - in addition to a weakening macro environment. The group as a whole is now decelerating back closer to pre-covid trends while GBV and room nights booked are starting to slow against 2019 levels. I also wonder how much Taylor Swift’s tour had/will have an impact on bookings for this year (as mentioned in last week’s post). It will an interesting space to watch over the coming quarters.

Source: company filings, FactSet

That’s all for this week. If you’ve made it this far, thanks for reading. If you’ve enjoyed this newsletter, consider subscribing or sharing with a friend.

I welcome any thoughts or feedback, feel free to shoot me an email at portseacapital@gmail.com. None of this is investment advice, do your own due diligence.

Tickers: META 0.00%↑, GOOG 0.00%↑ , SHOP 0.00%↑ , MELI 0.00%↑ , AMZN 0.00%↑ , PYPL 0.00%↑ , ABNB 0.00%↑ , BKNG 0.00%↑ EXPE 0.00%↑

I define the group as SHOP, ETSY, MELI, AMZN, EBAY and W. *Note I used net sales for W instead of GMV.